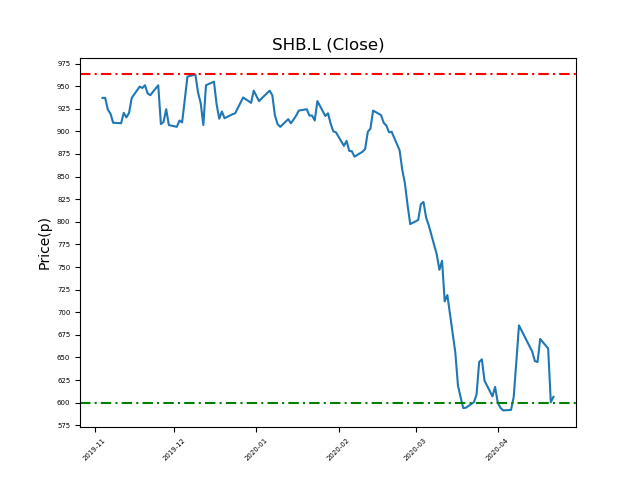

Shaftesbury PLC (SHB.L) 22-04-20

Will Shaftesbury PLC (SHB.L) shares break below the 600p support zone, or will it return to highs of 963p (+59%)?

- Currently trading around the 600p support at 603.5p (at time of writing).

- The price has tested this level repeatedly. Traders should be mindful of stop-loss placement.

- Highs of 963p have been seen in the recent past. Will we see this again? (+59%)

- Shares -38% from 12-month highs; +2% from 12 month lows.

Latest News

15 Apr: Barclays Capital reiterates its underweight rating on Shaftesbury (SHB) and reduced the target price to 525p (from 740p).

09 Apr: HSBC has upgraded its rating on Shaftesbury (SHB) to hold (from reduce) and reduced the target price to 525p (from 764p).

01 Apr: JP Morgan Cazenove reiterates its neutral rating on Shaftesbury (SHB) and reduced the target price to 900p (from 950p).

25 Mar: Liberum Capital has upgraded its rating on Shaftesbury (SHB) to buy (from hold) and reduced the target price to 900p (from 980p).

24 Mar: Shaftesbury, the London property investor, announced that it would not pay an interim dividend. It also cautioned that its full year earnings were likely to be significantly lower than previous expectations.

11 Mar: Morgan Stanley reiterates its underweight rating on Shaftesbury (SHB) and increased the target price to 770p (from 750p).

02 Mar: Jonathan Nicholls, Chairman, bought 15,000 shares within the firm on the 28th February 2020 at a price of 797.15p. This Director currently has 45,000 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires