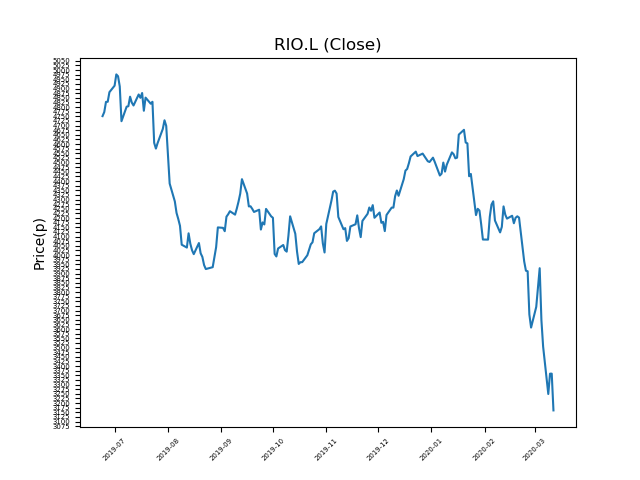

Rio Tinto (RIO.L) 12-03-20

Shares in Rio Tinto (RIO.L) have fallen dramatically from recent highs of 4976.5p. Will it continue, or is this an opportunity to pick up a bargain?

- Now trading at 3182.5p (at time of writing). A return to previous highs would represent a rise of 56%.

- The market often over-reacts to bad news. Traders should consider whether it is down for good reason, or is this another over-reaction?

- Shares -36% from 12-month highs; +0% from 12 month lows.

Latest News

10 Mar: Jakob Stausholm, Executive Director, bought 15,000 shares within the firm on the 9th March 2020 at a price of 3324.50p. This Director currently has 30,084 shares.

05 Mar: JP Morgan Cazenove reiterates its neutral rating on Rio Tinto (RIO) and reduced the target price to 4710p (from 4830p).

04 Mar: Societe Generale has upgraded its rating on Rio Tinto (RIO) to buy (from hold).

04 Mar: Rio Tinto announced that it had been given a resolution from shareholders urging the company to define emissions targets.

03 Mar: Jean-Sebastien Jacques, Chief Executive Officer, has transferred in 42,009 shares within the firm on the 27th February 2020 at a price of 3716p. This Director currently has 248,289 shares.

03 Mar: Jean-Sebastien Jacques, Chief Executive Officer, sold 20,841 shares within the firm on the 27th February 2020 at a price of 3716p. This Director currently has 227,448 shares.

28 Feb: Goldman Sachs reiterates its buy rating on Rio Tinto (RIO) and reduced the target price to 4550p (from 4900p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires