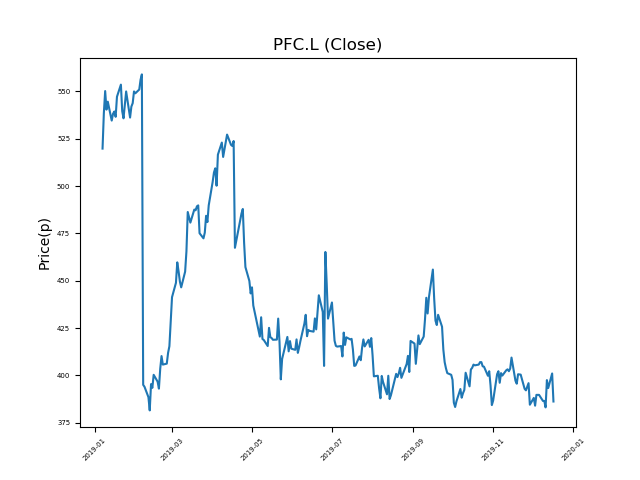

Petrofac Limited (PFC.L) 17-12-19

Petrofac Limited (PFC.L) has dropped from highs of 559p. Will it continue, or could you pick up a bargain?

- Now trading at 385.8p (at time of writing). A return to period highs would mean a rise of 44%.

- This shares are amongst the most significant fallers in the period.

- Markets constantly over-react to adverse news. Traders should consider whether the fall is reasonable, or is this another over-reaction?

- Bargain hunters should be mindful of the underlying fundamentals.

- Shares -31% from 12-month highs; +1% from 12 month lows.

Latest News

07:19: Petrofrac, the oil services company, announced that although it had seen some project bidding processes delayed, trading had been in line with expectations. It had new orders of $3bn in the year so far.

11 Dec: JP Morgan Cazenove reiterates its neutral rating on Petrofac Ltd (PFC) and reduced the target price to 450p (from 460p).

09 Dec: Jefferies International has downgraded its rating on Petrofac Ltd (PFC) to hold (from buy) and reduced the target price to 430p (from 500p).

26 Nov: Barclays Capital reiterates its overweight rating on Petrofac Ltd (PFC) and reduced the target price to 600p (from 670p).

20 Nov: Petrofrac announced that it would acquire onshore operations and maintenance company W&W Energy Services in the US. The deal is for an initial $22m, with added performance-based outlay.

28 Oct: Morgan Stanley has downgraded its rating on Petrofac Ltd (PFC) to equal weight (from overweight) and reduced the target price to 480p (from 500p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires