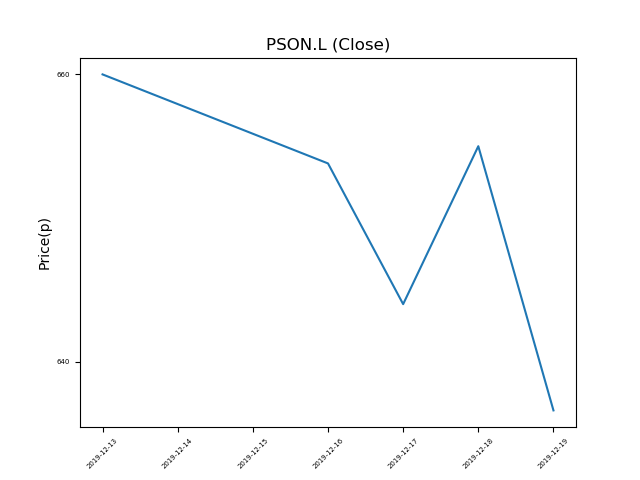

Pearson (PSON.L) 19-12-19

Shares in Pearson (PSON.L) have fallen dramatically from recent highs of 660p. Will it continue, or is this an opportunity to pick up a bargain?

- Now trading at 628.2p (at time of writing). A return to previous highs would represent a rise of 5%.

- The market often over-reacts to bad news. Traders should consider whether it is down for good reason, or is this another over-reaction?

- Shares -38% from 12-month highs; +0% from 12 month lows.

Latest News

08:20: Barclays Capital reiterates its underweight rating on Pearson (PSON) and reduced the target price to 620p (from 690p).

18 Dec: Pearson, the educational group, announced it had reached an agreement to dispose of its remaining 25% stake in Penguin Random House, the publisher. It would be sold to Bertelsmann for approximately $675m.

16 Dec: Berenberg reiterates its sell rating on Pearson (PSON) and reduced the target price to 525p (from 620p).

11 Dec: JP Morgan Cazenove reiterates its overweight rating on Pearson (PSON) and reduced the target price to 950p (from 1010p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires