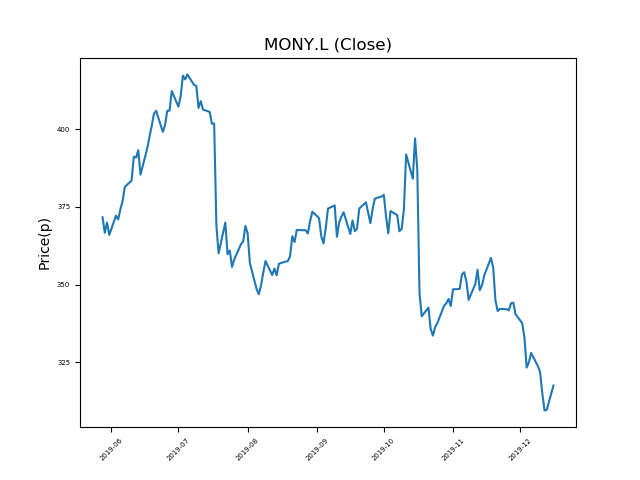

Moneysupermarket.com PLC (MONY.L) 16-12-19

Shares in Moneysupermarket.com PLC (MONY.L) have fallen dramatically from recent highs of 417.7p. Will it continue, or is this an opportunity to pick up a bargain?

- Now trading at 320.5p (at time of writing). A return to previous highs would represent a rise of 30%.

- This stock is one of the most significant fallers in the period.

- Is the trend your friend, or is a bounce imminent?

- The market often over-reacts to bad news. Traders should consider whether it is down for good reason, or is this another over-reaction?

- Bargain hunters should be mindful of fundamentals and events, which can influence price action. Check our website and news outlets for updates.

- Shares -23% from 12-month highs; +20% from 12 month lows.

Latest News

04 Dec: RBC Capital Markets has downgraded its rating on Moneysupermarket.com Group (MONY) to underperform (from sector performer) and reduced the target price to 300p (from 350p).

18 Oct: Barclays Capital reiterates its equal weight rating on Moneysupermarket.com Group (MONY) and reduced the target price to 365p (from 375p).

19 Jul: UBS reiterates its buy rating on Moneysupermarket.com Group (MONY) and increased the target price to 430p (from 415p).

18 Jul: Peel Hunt has downgraded its rating on Moneysupermarket.com Group (MONY) to hold (from add).

18 Jul: Moneysupermarket.com posted a 15% improvement in revenues for the first half, with its ‘Reinvent’ initiative boosting growth in new and existing markets.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires