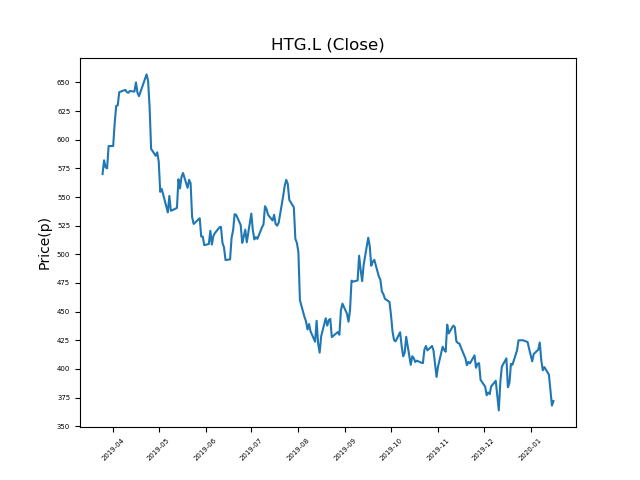

Hunting (HTG.L) 16-01-20

Shares in Hunting (HTG.L) have fallen dramatically from recent highs of 657p. Will it continue, or is this an opportunity to pick up a bargain?

- Now trading at 363.8p (at time of writing). A return to previous highs would represent a rise of 80%.

- The market often over-reacts to bad news. Traders should consider whether it is down for good reason, or is this another over-reaction?

- Shares -44% from 12-month highs; +0% from 12 month lows.

Latest News

08 Jan: UBS reiterates its buy rating on Hunting (HTG) and reduced the target price to 510p (from 590p).

18 Dec: JP Morgan Cazenove reiterates its neutral rating on Hunting (HTG) and reduced the target price to 460p (from 490p).

18 Dec: Berenberg reiterates its hold rating on Hunting (HTG) and reduced the target price to 450p (from 480p).

18 Dec: Barclays Capital reiterates its equal weight rating on Hunting (HTG) and reduced the target price to 490p (from 500p).

17 Dec: Hunting, the energy services group, announced that performance in December would determine whether expectations for the full year would be realised.

13 Dec: Barclays Capital reiterates its equal weight rating on Hunting (HTG) and reduced the target price to 500p (from 530p).

11 Dec: JP Morgan Cazenove reiterates its neutral rating on Hunting (HTG) and reduced the target price to 490p (from 642p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires