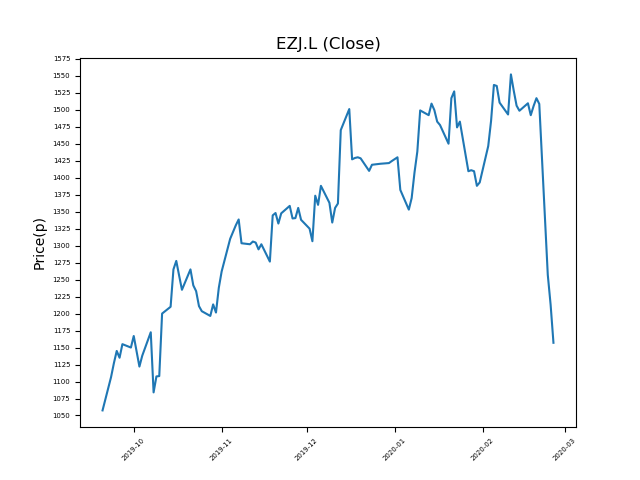

easyJet (EZJ.L) 26-02-20

Shares in easyJet (EZJ.L) have fallen notably from recent highs of 1552p. Will the trend prevail, or is this an opportunity for you to pick up a bargain?

- Currently at 1170.85p (at time of writing). A move up to highs would represent a rise of 32%.

- These share are amongst the biggest fallers in the period.

- Is the move unfinished, or are we about to see a bounce?

- The market has been known to over-react to bad news. Investors should consider whether these falls are justified, or is this an over-reaction?

- Shares -24% from 12-month highs; +37% from 12 month lows.

Latest News

12 Feb: Citigroup reiterates its buy rating on easyJet (EZJ) and increased the target price to 1700p (from 1650p).

05 Feb: Societe Generale has upgraded its rating on easyJet (EZJ) to hold (from sell) and increased the target price to 1440p (from 1280p).

27 Jan: Bernstein reiterates its market perform rating on easyJet (EZJ) and increased the target price to 1450p (from 1350p).

27 Jan: UBS reiterates its sell rating on easyJet (EZJ) and increased the target price to 1275p (from 1240p).

24 Jan: Commerzbank reiterates its hold rating on easyJet (EZJ) and increased the target price to 1675p (from 1600p).

24 Jan: EasyHotel posted to a loss for the year as the low-cost hotel chain wrote down a property in Ipswich, UK.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires