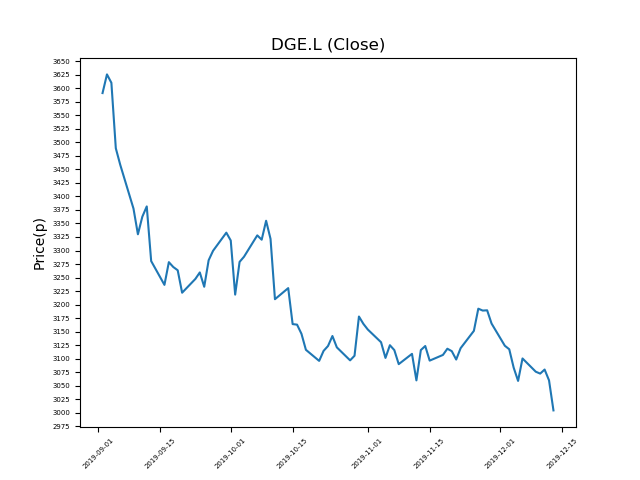

Diageo (DGE.L) 13-12-19

Shares in Diageo (DGE.L) have dropped from recent highs of 3625.5p. Are further falls imminent, or will investors benefit from this low price?

- A return to previous highs would represent a rise of 19%. Now trading at 3031p (at time of writing).

- This stock is one of the most significant fallers in the period.

- Is the fall justified? Is a bounce due?

- The market has been known to over-react to negative news. Traders may wish to consider whether the fall is reasonable, or is the recent fall an over-reaction?

- Contrarian traders should be mindful of fundamentals and events, which can influence price. Check our website for updates.

- Shares -16% from 12-month highs; +12% from 12 month lows.

Latest News

10 Dec: JP Morgan Cazenove reiterates its neutral rating on Diageo (DGE) and reduced the target price to 3200p (from 3315p).

10 Dec: Javier Ferrán, Chairman, bought 271 shares in the firm on the 10th December 2019 at a price of 3051.00p. This Director currently has 231,731 shares.

10 Dec: Bernstein reiterates its market perform rating on Diageo (DGE) and reduced the target price to 3250p (from 3300p).

03 Dec: RBC Capital Markets has upgraded its rating on Diageo (DGE) to outperform (from sector performer) and increased the target price to 3500p (from 3100p).

11 Nov: Javier Ferrán, Chairman, bought 267 shares in the firm on the 11th November 2019 at a price of 3096.00p. This Director currently has 231,460 shares.

10 Oct: Javier Ferrán, Chairman, bought 249 shares in the firm on the 10th October 2019 at a price of 3321.00p. This Director currently has 231,193 shares.

20 Sep: Deutsche Bank reiterates its hold rating on Diageo (DGE) and increased the target price to 3650p (from 3500p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires