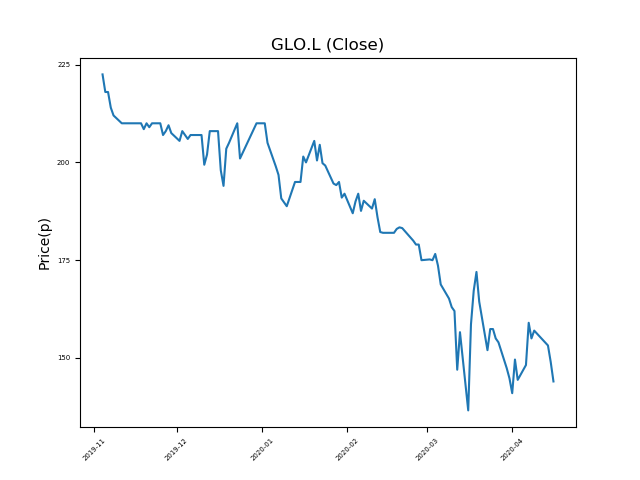

ContourGlobal (GLO.L) 17-04-20

ContourGlobal (GLO.L) has fallen dramatically from recent highs of 222.5p. Will it continue, or is this an opportunity to pick up a bargain?

- Now trading at 143.6p (at time of writing). A return to previous highs would represent a rise of 54%.

- This stock is one of the most significant fallers in the period.

- Is the trend your friend, or is a bounce imminent?

- The market often over-reacts to bad news. Investors should consider whether it is down for good reason, or is this another over-reaction?

- Investors seeking a bargain should be mindful of fundamentals and events, which can influence price action. Check our website and news outlets for updates.

- Shares -35% from 12-month highs; +5% from 12 month lows.

Latest News

07 Apr: RBC Capital Markets reiterates its outperform rating on Contourglobal Plc Ord 1p Wi (GLO) and reduced the target price to 205p (from 310p).

17 Mar: ContourGlobal, the power generating asset company, posted an increase in profit as revenue was lifted by acquisitions. The company also announced it was to abandon plans to build a coal installation in Kosovo.

10 Jan: Exane BNP Paribas reiterates its outperform rating on Contourglobal Plc Ord 1p Wi (GLO) and reduced the target price to 300p (from 310p).

05 Dec: ContourGlobal announced that profits for the year would be ‘modestly’ shy of previous expectations due to delays in completing a takeover in Mexico.

12 Aug: Joseph Brandt, Chief Executive Officer, bought 47,400 shares within the firm on the 8th August 2019 at a price of 165.51p. This Director currently has 1,736,927 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires