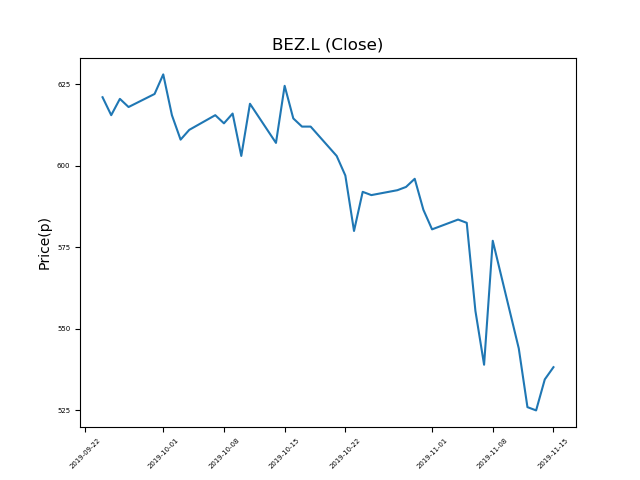

Beazley (BEZ.L) 15-11-19

Beazley (BEZ.L) has fallen dramatically from recent highs of 628p. Will it continue, or is this an opportunity to pick up a bargain?

- Now trading at 532p (at time of writing). A return to previous highs would represent a rise of 18%.

- This stock is one of the most significant fallers in the period.

- Is the trend your friend, or is a bounce imminent?

- The market often over-reacts to bad news. Investors should consider whether it is down for good reason, or is this another over-reaction?

- Investors seeking a bargain should be mindful of fundamentals and events, which can influence price action. Check our website and news outlets for updates.

- Shares -15% from 12-month highs; +8% from 12 month lows.

Latest News

14 Nov: David Roberts, Chairman, bought 9,450 shares in the firm on the 13th November 2019 at a price of 531.85p. This Director currently has 50,750 shares.

12 Nov: Peel Hunt reiterates its reduce rating on Beazley (BEZ) and reduced the target price to 450p (from 460p).

11 Nov: UBS reiterates its buy rating on Beazley (BEZ) and reduced the target price to 630p (from 650p).

08 Nov: Beazley, the insurance company, announced that premiums had grow in the year to September (9 months), amongst what it sees as a difficult claims environment.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires