This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

Q3 Stock Picks – P3 – Stock Picks

Barratt Developments (BDEV)

Source: CMC Markets, 27 June 2018

Barratt Developments is one of the largest residential property developers in the United Kingdom. While 2018 has been tough on UK housebuilders, ensnared in a weakening housing market and Brexit uncertainty, more recent developments give cause for cautious optimism.

Nationwide House Prices rising 2% in June (beating estimates) and the Halifax Housing Index showing an improvement from April lows could be pointing toward a recovery, potentially benefiting housebuilders. However, risk of Brexit uncertainty could keep London housing market (important for Barratt Developments) soft, souring the stock’s potential.

Barratt Developments share price has fallen close to 21% from 2018 highs, but has since recovered 2%, with a potential support level forming around 517p.

Will Barratt return to highs of 660p (+27%) or fall back to lows of 467p (-10%)?

Next Event: FY Sales and Revenue – Trading Update, 11 July

Broker Consensus: 64.7% Buy, 25.5% Hold, 11.8% Sell

Bullish: Jefferies, Buy, Target 795p, +53% (25 June 18)

Average Target: 639p, +23% (28 June 18)

Bearish: Liberum, Hold, Target 525p, +1% (1 June 18)

Pricing data sourced from Bloomberg on 27 June. Please contact us for a full, up to date rundown.

British American Tobacco (BATS)

Source: CMC Markets, 27 June 2018

British American Tobacco is a classic example of a defensive stock. Its products are non-cyclical, meaning that they will find sufficient consumer demand even in economic downturn. Current geopolitical tensions involving trade and tariffs open potential for investors to flock into defensive stocks like British American Tobacco.

Shares have been on a recent downtrend, losing 26% of their value since the highs of 2018, but have recovered 5.7% from the year’s lows, potentially finding a bottom at February 2016 support level of 3600p. In mid-June, British American Tobacco shares staged a bullish breakout of this year’s falling highs resistance. Risk remains, however, that a UK Index rally could create a preference for riskier stocks (e.g. banks, miners) or that a stronger GBP could damage the company’s earnings.

Broker consensus on British American Tobacco is strongly bullish, with over 76% of analysts saying “Buy”, 24% advocating for “Hold” and zero negatively biased brokers. All 17 brokerages with recent updates on British American Tobacco project a medium-term upside from the stock’s current share price.

Will BATS return to highs of 4321p (+15%) or fall back to lows of 3388p (-10%)?

Next Event: H1 Results, 26 July

Broker Consensus: 76% Buy, 24% Hold, 0% Sell

Bullish: Investec, Buy, Target 5500p, +46% (21 June 18)

Average Target: 4780p, +27% (27 June 18)

Bearish: RBC Capital Markets, Sector Perform, Target 3800p, +1% (13 June 18)

Pricing data sourced from Bloomberg on 27 June. Please contact us for a full, up to date rundown.

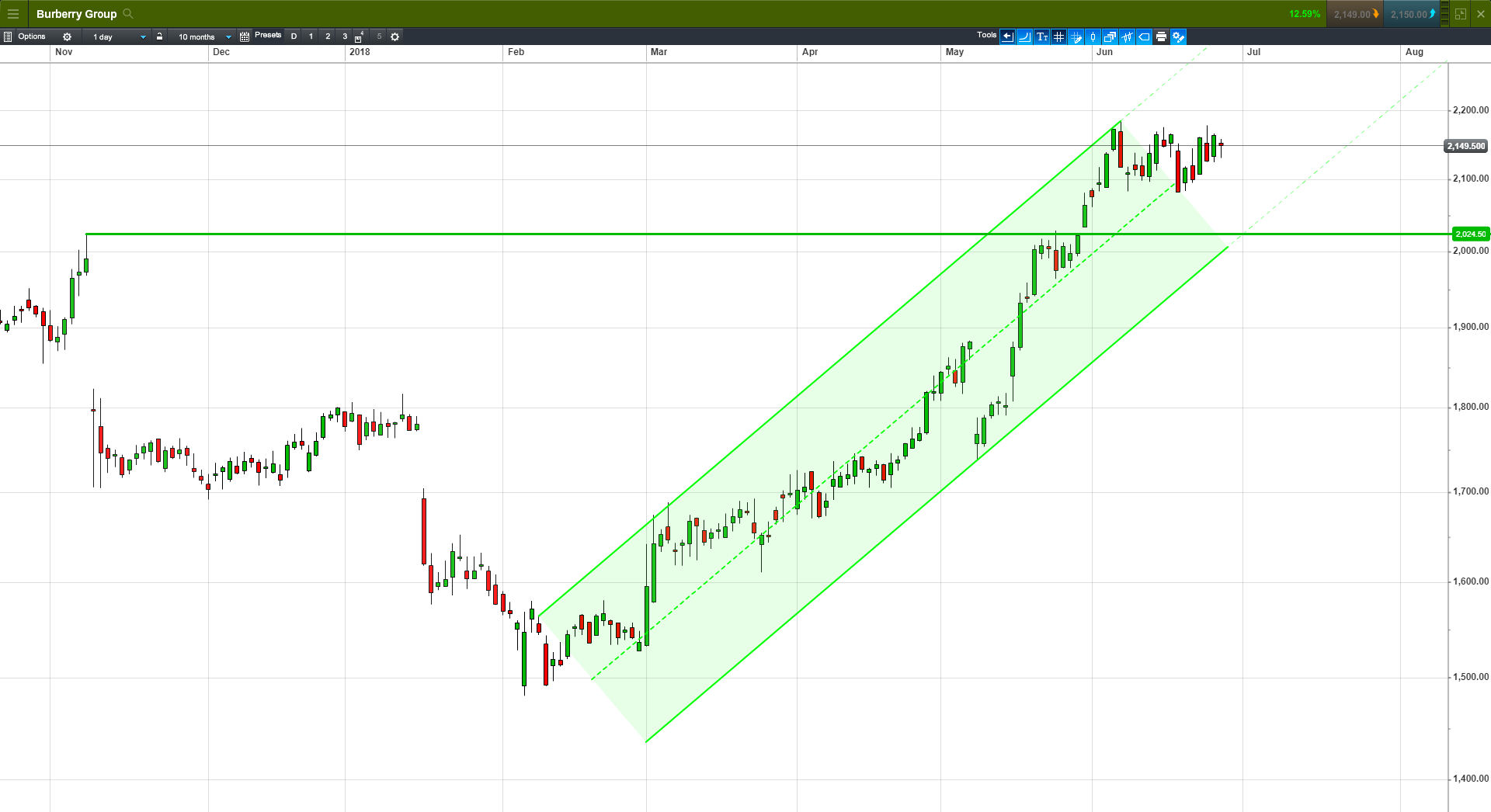

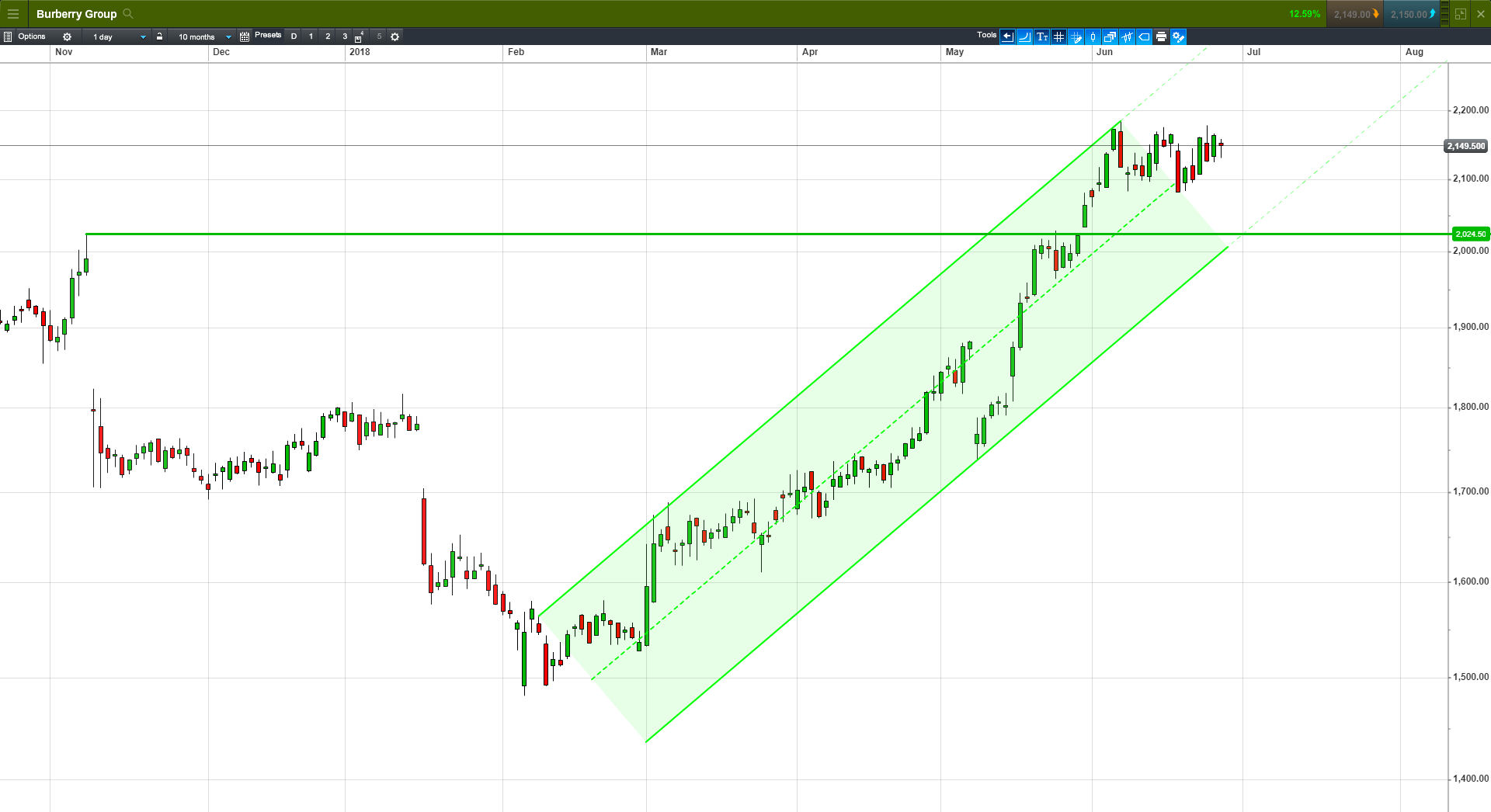

Burberry (BRBY)

Source: CMC Markets, 27 June 2018

Luxury fashion designer Burberry has seen its shares on a strong uptrend since the second quarter of 2018 (+45% from 2018 lows), with a rising channel since May and a bullish breakout in June from the highs of November 2017. As a luxury goods manufacturer, Burberry is typically resistant to global economic concerns, while a weaker GBP provides some tailwind to profits.

Competition for luxury market is relatively high, creating a risk. Threat of a stronger GBP, if the Bank of England increases its interest rates in August, could create an FX headwind for Burberry.

Broker consensus on Burberry is very neutral, with half of analysts suggesting a more long-term “Hold” strategy. At the same time, recent strong share price momentum and bullish breakout could induce some of these neutral brokers to upgrade their ratings.

Will Burberry go to new highs 2400p (+12%) or fall back to 2024p support (-6%)?

Next Event: Q1 Trading Update, 11 July

Broker Consensus: 21% Buy, 50% Hold, 29% Sell

Bullish: Goldman Sachs, Buy/Neutral, Target 2415p, +12% (16 May 18)

Average Target: 1860p, -13% (27 June 18)

Bearish: Invest Securities SA, Neutral, Target 1560p, -27% (2 November 16)

Pricing data sourced from Bloomberg on 27 June. Please contact us for a full, up to date rundown.

Fresnillo (FRES)

Source: CMC Markets, 27 June 2018

Source: CMC Markets, 27 June 2018

Shares of precious metals miner Fresnillo have retreated from their May peak and are within close distance to the December 2016 support level of 1118p. Positive Q1 production report in late May sent the shares to multi-month highs and recent share-price sell-off (-21% from 2018 highs) could make Fresnillo a potentially attractive bargain stock.

With a new Q2 production report scheduled to be released on 25 July, the miner’s shares could see some benefit and reverse back to May highs, though risk always remains that poor production will lead to an extension of the downtrend.

Brokers have a generally positive bias toward Fresnillo, with 44% of analysts saying “Buy”, 56% holding a neutral stance and no negatively disposed brokers. All 13 of the recent broker updates see a share price upside from current levels.

Will Fresnillo go to falling highs of 1330p (+16%) or fall back to 1110p lows (-4%)?

Next Event: Q2 Production Update, 25 July

Broker Consensus: 44% Buy, 56% Hold, 0% Sell

Bullish: BMO Capital Markets, Outperform, Target 1650p, +44% (25 June 18)

Average Target: 1860p, -13% (27 June 18)

Bearish: RBC Capital Markets, Sector Perform, Target 1200p, +5% (25 June 18)

Pricing data sourced from Bloomberg on 27 June. Please contact us for a full, up to date rundown.

Micro Focus International (MCRO)

Source: CMC Markets, 27 June 2018

Software giant Micro Focus International had a disappointing year with an H1 profits warning after a less-than-stellar acquisition of rival enterprise software developer HPE. Micro Focus shares are 51% below 2018 highs, after a drastic fall in March, but have since recovered an impressive 61% of their value, pointing out, perhaps, that the original sell-off was a market overreaction.

Brokers are rather bullish on Micro Focus, sensing a potential bargain and an ability of the share price to close the gap back to March highs. A healthy 63% of brokers see an upside from current price levels, with the most recent update from Numis Securities projecting an impressive medium-term share price of 2010p.

Investors should still be mindful that more corporate earnings problems at Micro Focus related to HPE merger could hurt share price recovery, with upcoming H2 results serving as an important guide for share price direction.

Will Micro Focus close the gap to 1883p (+43%) or fall back to 1115p lows (-15%)?

Next Event: H2 Results, 11 July

Broker Consensus: 42% Buy, 42% Hold, 17% Sell

Bullish: Numis Securities, Buy, Target 2010p, +52% (1 June 18)

Average Target: 1410p, +7% (27 June 18)

Bearish: J.P. Morgan, Underweight, Target 900p, -32% (16 May 18)

Pricing data sourced from Bloomberg on 27 June. Please contact us for a full, up to date rundown.

Ocado (OCDO)

Source: CMC Markets, 27 June 2018

Ocado is an online grocery retailer that has also developed a sophisticated online shopping platform which it licenses to major food retailers around the world. Ocado’s shares have been experiencing an impressive positive momentum in 2018 (158% year-to-date) after company inked a string of successful partnership deals in the UK (Morrison’s), Sweden, France, Canada and, most recently, the US with retail giant Kroger.

Ocado shares are down 10% from early June highs, with recent uptrend turning shallower and sideways. In the past, big jumps in Ocado’s share price came alongside news of new partnerships. Going forward this can present both an investment opportunity (news of new deals) and a risk (agreements failing or a long eventless periods).

Broker consensus on Ocado is relatively mixed, with many analysts still sitting on the fence (45% neutral), doubtful over Ocado’s transition toward being a platform developer rather than a pure online supermarket. Some brokers, however, are starting to warm up to the idea, with the recent update from Peel Hunt projecting an impressive 1700p target price (+60% from current levels).

Will Ocado go to new highs of 1200p (+13%) or fall to 918p mid-June lows (-10%)?

Next Event: H1 Results, 10 July

Broker Consensus: 33% Buy, 45% Hold, 22% Sell

Bullish: Peel Hunt, Buy, Target 1700p, +60% (21 June 18)

Average Target: 823p, -22% (27 June 18)

Bearish: Société Générale, Sell, Target 207p, -80% (7 May 18)

Pricing data sourced from Bloomberg on 27 June. Please contact us for a full, up to date rundown.

Royal Mail Group (RMG)

Source: CMC Markets, 27 June 2018

Royal Mail has been a household name in the United Kingdom for centuries, most of the time serving as a public postal service. The company has been publicly listed on the London Stock Exchange and a member of UK 100 since 2014.

Royal Mail shares are down 20% from May highs, when the company announced its latest results, with markets reacting negatively to news that FY pre-tax profits fell 37%. The share price fall has slowed down in June, with the stock now trading more than 12% above year’s lows. With Royal Mail’s shares stabilising, this represents a potential investment opportunity to take advantage of the stock’s relative bargain value.

Be mindful of potential disappointment of upcoming Q1 Trading Update (17 July). If company once again delivers poor results, shares could fall below recent support level. Bloomberg’s collation of broker comments reflects both possibilities, with majority of analysts (56%) advocating for a wait-and-see approach, though a positive trading update could induce some of the neutrals to upgrade their preference.

Will Royal Mail return to May highs of 632p (+26%) or fall to 445p 2018 lows (-11%)?

Next Event: Q1 Trading Update, 17 July

Broker Consensus: 6% Buy, 56% Hold, 37% Sell

Bullish: Barclays, Buy, Target 630p, +25% (30 May 18)

Average Target: 506p, +1% (27 June 18)

Bearish: Jefferies, underperform, Target 400p, -20% (25 June 18)

Pricing data sourced from Bloomberg on 27 June. Please contact us for a full, up to date rundown.

Randgold Resources (RRS)

Source: CMC Markets, 27 June 2018

Miner Randgold Resources, which develops gold deposits in West and Central Africa, historically has been a stable Q3 performer. Although the stock’s price movements have been disappointing bullishly-minded investors in 2018 (shares down 23% from 2018 highs), it has been typically performing well during past summer months. The stock has potentially found its H1 2018 bottom (+ 3% from 2018 lows), with share price consolidating into a ranging motion.

Broker consensus is positively biased, with 66% of analysts saying “Buy”, 28% neutral and only 5% saying “Sell”. Average broker target price of 7168p is far above current levels and an impressive 95% of brokers are projecting a medium-term upside from current share price levels.

Most recent broker update from Macquarie (27 June) is forecasting Randgold shares to rise above 2018 highs (7475p) and reach the level of 7600p in the medium term, last seen in September 2017.

Will Randgold go to 6475p February highs (+14%) or retreat below 5432p 2016 lows (-4%)?

Next Event: H1 Results, 9 August

Broker Consensus: 67% Buy, 28% Hold, 5% Sell

Bullish: CIBC Capital Markets, Outperform, Target 9500p, +67% (26 June 18)

Average Target: 7168p, +26% (27 June 18)

Bearish: RBC Capital Markets, Underperform, Target 4900p, -14% (26 June 18)

Pricing data sourced from Bloomberg on 27 June. Please contact us for a full, up to date rundown.

Sage Group (SGE)

Source: CMC Markets, 27 June 2018

Sage Group is a multinational enterprise software developer based in the UK. It is the third-largest developer of business IT applications in the world after Oracle and SAP, and one of the two IT companies on the UK 100 index of blue chips (with Micro Focus International).

Sage Group shares represent a potentially attractive Q3 investment opportunity as more investors are hunting for bargain deals. Shares are nearly 24% below their 2018 highs after company missed H1 revenue expectations. Since April, Sage has clawed back some of those losses, rising 16% from year’s lows and addressing many of the investor worries. With investors paying close attention to organic revenue growth, the upcoming Q3 Trading Update could serve as an important milestone for the company’s recovery.

With brokers evenly split between bulls (42%) and neutrals (42%), with bears making up the remaining 16%, a reassuring trading statement could induce some of the neutrals to upgrade their ratings. Three-quarters of all brokers project an upside from current prices, with an average target price (712p) 13% above current levels.

Will Sage Group return to 824p 2018 highs (+31%) or go back to April lows of 594p (-6%)?

Next Event: Q3 Trading Update, 2 August

Broker Consensus: 42% Buy, 42% Hold, 16% Sell

Bullish: Stifel, Buy, Target 826p, +31% (14 May 18)

Average Target: 712p, +13% (27 June 18)

Bearish: Day by Day, Sell, Target 510p, -19% (3 April 18)

Pricing data sourced from Bloomberg on 27 June. Please contact us for a full, up to date rundown.

Shire (SHP)

Source: CMC Markets, 27 June 2018

Shire is a leading global biopharmaceutical company, with a speciality in treatment of rare diseases. The company is a lucrative target for takeover efforts from several international biotech companies, most recently by the Japanese pharmaceutical company Takeda.

Recent share price performance of Shire reflected these takeover efforts, with the company’s shares on an uptrend since March (+38% from 2018 lows). Day to day, Shire stock price often reflects movements of Takeda shares in Japan, due to a large component of new Takeda stock in the bid. Much works remains ahead for Takeda in absorbing a company that is double its own size, with any funding snags (Takeda will take on new debt to fund the takeover) representing a measurable risk for Shire’s investors.

Brokers are generally upbeat on Shire’s prospects, with 66% of analysts recommending “Buy”, 30% neutrals and only 4% advocating for “Sell”. With an average medium-term target price of 4525p, a significant 70% of brokers see an upside from current price levels.

Will Shire rise to July 2017 4642p highs (+13%) or fall back to 3807p May lows (-7%)?

Next Event: H1 Results, 2 August

Broker Consensus: 66% Buy, 30% Hold, 4% Sell

Bullish: Société Générale, Buy, Target 7500p, +83% (24 May 18)

Average Target: 4525p, +11% (27 June 18)

Bearish: Day by Day, Sell, Target 2243p, -45% (4 May 18)

Pricing data sourced from Bloomberg on 27 June. Please contact us for a full, up to date rundown.

« Back to Category

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance.

Prepared by Michael van Dulken, Head of Research