This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

Bargain Blue Chips – P2 – Stocks

Dialling the wrong number

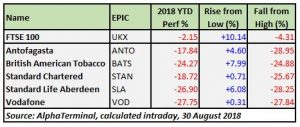

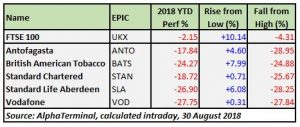

World’s second-largest mobile provider Vodafone is the only telecom stock on UK 100 , but it occupies an outsize presence in many investors’ portfolios. The stock has not fared well in 2018, falling ~28% year-to-date and currently trading close to levels last seen in 2013. Company’s decision to spend $23bn in the beginning of the year on Liberty Global telecom assets in Europe spooked investors and the departure of a long-serving CEO Vittorio Colao added to market’s uncertainty regarding Vodafone’s direction.

Copper miner Antofagasta is the most recent victim of Sino-US trade confrontation. As a top producer of red metal, China has an outside impact on metals & mining companies and the new tariffs which President Trump has put on Chinese imports have severely hurt UK Index ’s Mining sector. Antofagasta is sector’s biggest laggard, falling ~29% from 2018 highs and bouncing back the least (~5%) from the lows compared to peers. Half-year results in mid-August fell short of expectations, as copper production decreased while costs rose.

Rainy day savings

Financial sector has been another 2018 laggard, with wealth management company Standard Life Aberdeen the biggest sector faller on UK 100 . Shares in the firm that manages many of the UK’s corporate pension schemes have fallen close to 27% since the beginning of the year. The chain of disappointing news started in February when Lloyds terminated the £109bn insurance management arrangement and continued when S&P credit ratings agency downgraded the company in August due to track record of sustained net fund outflows.

Emerging markets-focused bank Standard Chartered is another firm which has not done well in 2018, its share price down 19% in 2018 and currently trading near recent lows (having bounced less than 1% from the year’s bottom). Half-results were relatively downbeat, and the bank remains under the shadow of US investigation into its sanctions-busting activities in Iran. Bank’s exposure to Asian emerging markets has also hurt Standard Chartered due to the ongoing concerns over the aftereffects of US-China reciprocal trade confrontation spreading to other regional economies.

Smoke and mirrors

Another company that has not been able to benefit from UK Index ’s Q1 rush to record highs was the tobacco products manufacturer British American Tobacco. As a defensive company, its shares typically suffer during periods of market rallies, when investor sentiment gives preference to riskier assets. With UK Index ’s rise aborted during the summer, BAT shares are coming back into favour. Recent results pleased investors, as revenues rose 57% YoY and the company gained bigger portion of cigarette market share.

Another company that has not been able to benefit from UK Index ’s Q1 rush to record highs was the tobacco products manufacturer British American Tobacco. As a defensive company, its shares typically suffer during periods of market rallies, when investor sentiment gives preference to riskier assets. With UK Index ’s rise aborted during the summer, BAT shares are coming back into favour. Recent results pleased investors, as revenues rose 57% YoY and the company gained bigger portion of cigarette market share.

Over the next several pages, we discuss the technical aspects of these 5 bargain stocks, including medium-term charts, potential support and resistance levels, as well as broker recommendations and target prices.

Do you have an opinion of what will happen to these stocks in the second half of 2018 and want to take advantage of a tradable opportunity? Get in touch with one of our brokers to discuss your options.

« Back to Category

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance.

Prepared by Michael van Dulken, Head of Research