Halloween may be behind us, but London investors are still feeling spooked by the general equity sell-off that left no stone unturned and sent the blue-chip UK Index index as low as 9% down, a mere whisker away from a 10% technical market correction.

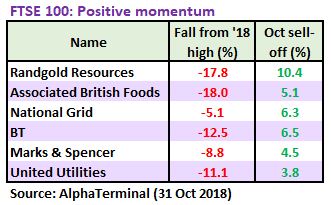

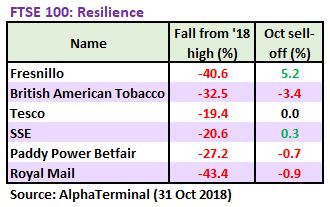

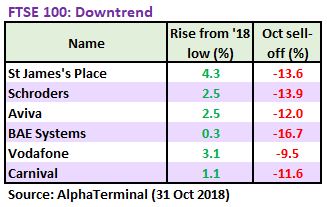

But while the UK Index may be down a full 11% off its best levels seen in late May, there are plenty of exciting trading opportunities to take advantage of today.

The following report will look at the origins of the current bearish sentiment, examine the reasons for trading during a sell-off and give you a full overview of several UK Index stocks defying the downtrend.

Is there a Goldilocks trading opportunity in-play today? We have found several. Continue reading to find an opportunity just right for you.

Natural reaction

The most recent stock market correction began on 3 October when the UK Index was trading around 7530 level. The initial sharp sell-off continued over the following 6 trading days to 6923 lows.

The fall did not stop there, although its pace slowed down, and the UK Index went on to lose another 70 points to trade close to the 2018 low of 6839. The index is off its worst levels for now, but it is far from clear if the final curtain already rose over the sell-off.

There are many reasons for this market correction. Some economists point to the continued lack of a final Brexit deal with less than half a year remaining until UK exits the EU, adding to business uncertainty.

Others blame the ratcheting of the Sino-US tensions that has hammered shares of London-based multinational companies which depend on international trade.

The latest consensus points to the mixed Q3 earnings season in the United States, with many global growth barometers such as Amazon, Caterpillar and General Electric missing the analysts’ earnings expectations.

Mixed corporate results highlighted the issue with ballooning equity valuations that are underpinned by share buybacks and distortionary liquidity rather than genuinely strong trading fundamentals. The current sell-off appears to be a healthy market reaction to correct these market imbalances.

Longer-term perspective

It is also important to keep bearish sentiment in perspective. The October fall may seem dramatic, but this is hardly the first sell-off in recent memory.

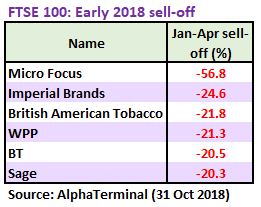

Beginning in January 2018, the UK Index fell 950 points (13.8%) over a 2-month period. The sell-off started in the United States, as expectations grew that the Fed would continue raising interest rates to combat growing inflation under the freshly appointed Chairman Jerome Powell. The era of cheap money was coming to an end and it was high time for a correction in global equities, overvalued relative to their fundamentals.

The negative sentiment spread across world markets, the UK Index losing close to 200 points (-2.6%) on 6 Feb, its worst trading session since Brexit.

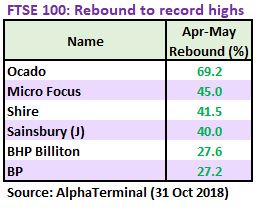

And yet, despite these bruising losses, the UK Index proved resilient. After reaching the bottom of the sell-off in late March, it would go on to rally over 15%, recovering all earlier losses and reaching record high levels in late May.

For continuing analytical coverage of UK and international markets, you can also sign up to have our research sent directly to your inbox.