“Sell in May, Go Away, Come back on St Leger’s Day”. We’ve all heard the stockbroker cliché and for many it has become an easy punching bag for disproving so-called “conventional wisdom” on financial markets seasonality.

Market watchers are divided into two camps, one of which believes there are clear seasonal patterns to financial markets and trading, while the other is convinced that the markets are too unpredictable to be subject to simple “folksy” rules. Both sides of the debate have logic behind their arguments.

We at Accendo Markets believe in looking beyond the simple patterns that support or disprove popular proverbs and, instead, prefer to examine and analyse actual market data to help ensure our clients are better informed and more savvy investors. We already discussed the “Sell in May” theory in a 2015 report, and believe it is time to update our analysis to take an even more nuanced look at UK 100 companies and determine whether our clients can benefit from any seasonal patterns in their trading/investing.

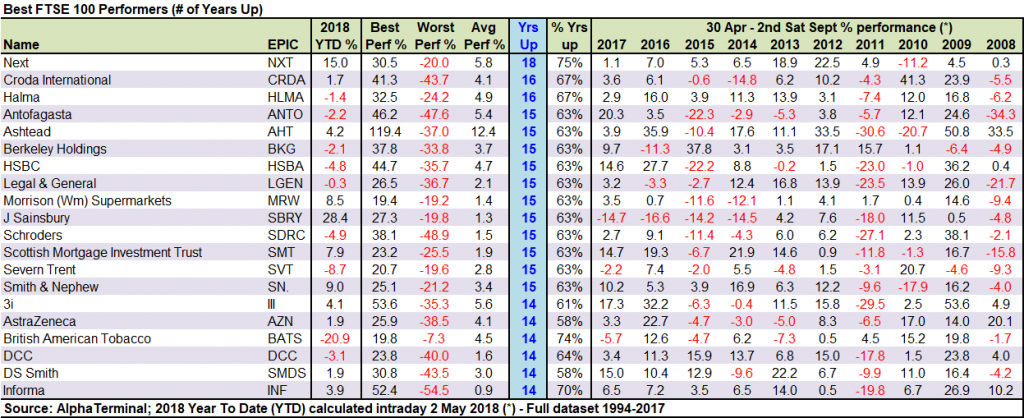

Here’s a small preview. During summer months, British American Tobacco shares rose 14 times in the last 24 years, a 74% positive rate, delivering +4.5% average share price growth.

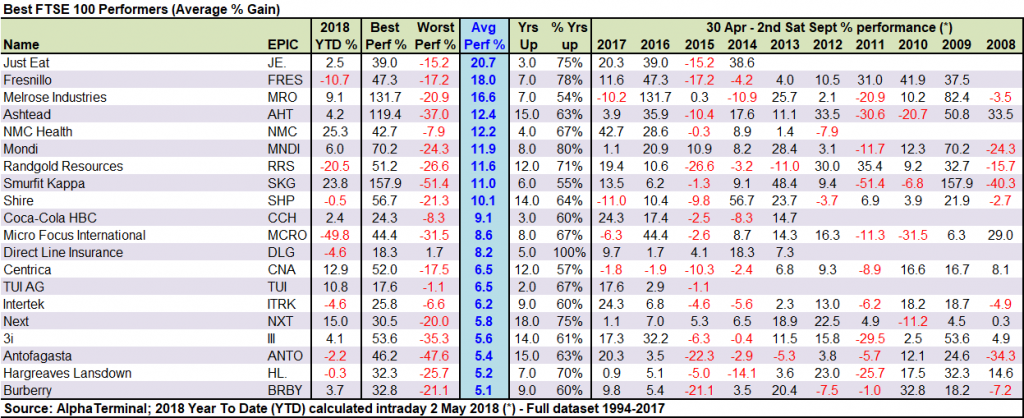

Relative newcomer to London Stock Exchange, Direct Line Insurance has traded publicly only 5 years, but it has seen its share price rise in every single summer period (+8.2% average share price growth). How’s that for seasonality?

Folk Wisdom

Just in case you have never come across the “Sell in May” adage, the theory goes like this. The St Leger Stakes is a prestigious horse race that takes place in at Doncaster, on St Leger’s Day, traditionally the second Saturday in September. Accordingly, the old saying is suggesting that investors should sell their holdings in May, be conservative with their investments during the summer and increase their activity in the second half of September.

There are many potential “reasons” for why the summer is a particularly disadvantageous period for investing. These include lower market volatility (which increases uncertainty and asset risk), lower general economic activity (e.g. lower company revenues and profits), and simply a lack of investor interest due to holidays.

However, for every simplistic reason to support the adage, there is an equally strong (albeit still simplistic) argument to counter it. If utility companies see less demand during the summer (we heat our homes less), retailers/restaurants/pubs should benefit from the good weather boosting consumer confidence.

Accendo Markets’ research team issues daily publications on indices, commodities and blue-chip equities. Read on to find out more about the companies that typically outperform and underperform during the summer period and sign up to have our research sent directly to your inbox.