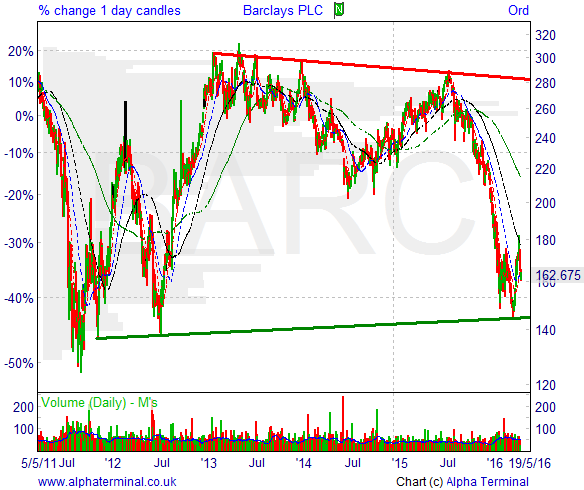

As we begin the new month, an interesting situation has presented itself in the stock market today. The riskier stocks on the UK 100 have rallied hard from their 2016 low points and are understandably taking a break - some have risen by over 100% after all! Yet there’s another interesting observation we’ve made. Several UK 100 blue chip stocks have made fresh all-time highs in 2016. These stocks are, in the main, defensives and have been quietly trudging north in the background while all the attention has been on the popular but rather wild miners and banks - understandably, you might think, what with the turmoil we experienced in January and February.

But the Brexit fears (UK referendum on exit from EU) everyone has spoken of don’t appear to have manifested themselves in the stock markets. China continues to be China. Perhaps most pertinent is an impressive oil price recovery rally that’s surpassed anything the wider commodities space has had to offer. 2016 has seen risk assets rally hard from their lows while defensives have pushed on to make fresh all-time highs. Win-win.

The point is that with riskier stocks rising, indicating increasing confidence, one would expect defensives to sell off at the same time. But with defensive, non-cyclicals trading at or near all-time highs this implies that the moves thus far have been speculative in nature and that funds have yet to flow from safer investments to riskier ones. This is a potential bullish signal for the stock market today, indicating there could be more upside for cyclical stocks.

If you think you missed out on the rally, think again. If you’re still a little risk averse, then there are still attractive dividend plays out there too. There’s something for everyone.