A bumper IPO line-up

The UK market is experiencing yet another solid year for Initial Public Offerings (IPOs), maintaining the trend of the last two years with total listings worth an estimated £20bn expected by year-end. This confirms a still very healthy appetite for new shares, even if less than that of 2014 which saw a frenzied rush to market as equities rallied and private-equity owners factored in the prospect of higher interest rates.

While stock exchange data shows 93 UK IPOs in first 9 months of 2015 raising £5.3bn (vs £11bn from 136 in the same period last year) a whole host of companies remain queued up to sell stakes to the public in 2015. With UK Election risk behind us and rate hikes still on ice, the flow is seen continuing.

While IPO issuance momentum has certainly slowed since Summer 2014, the quality remains and we have seen some very successful and high-profile names list. Challenger bank Virgin Money (VM.) was valued at £1.25bn in November while online automobile marketplace Auto Trader (AUTO) the biggest so far in 2015, worth a whopping £2.4bn in March. Note both companies’ shares have gained 35-40% since coming to market. But there is plenty more to come.

In this report Accendo Markets highlights potential IPOs for 2015 and 2016 with a variety of names which could deliver interesting trading opportunities both pre-and post-IPO.

How can you trade IPOs?

With not all IPOs open to the public (buying shares from the company at the official IPO offer price) due to listings often being reserved for financial institutions only, we look at the alternatives available to the public; such as Grey market and Conditional Trading.

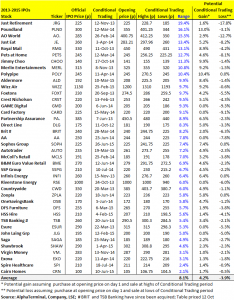

Looking at the statistics for the biggest and most covered IPOs of the last few years, we note that the conditional trading option (explained in detail later) has offered extremely attractive trading opportunities with an impressive 65% of companies still trading above their official IPO price.

Some of the names we can expect to IPO in October include Hasting Direct and Worldpay with the latter potentially being the biggest IPO since Royal Mail (RMG) got the IPO frenzy going in Sept 2013.

Confirmed 2015 Listings

Motor insurer Hastings Direct could be valued at £1.5bn which would make one of the biggest UK IPOs of 2015 and see it join the likes of Direct Line Group (DLG) which was worth £2.6bn in Oct 2012 but whose shares have more than doubled since.

Payment processing firm Worldpay could be the big one, however, worth £5bn making it the biggest London IPO since 2011 after the company declined a takeover offer from French rival Ingenico.

Hastings and Worldpay are due to IPO in London in October while Ferrari has opted for a $10bn New York float. To learn more about these three read on.