William Hill

Is this an opportunity to take a position ahead of the results?

William Hill reports results on Tuesday, 6 November

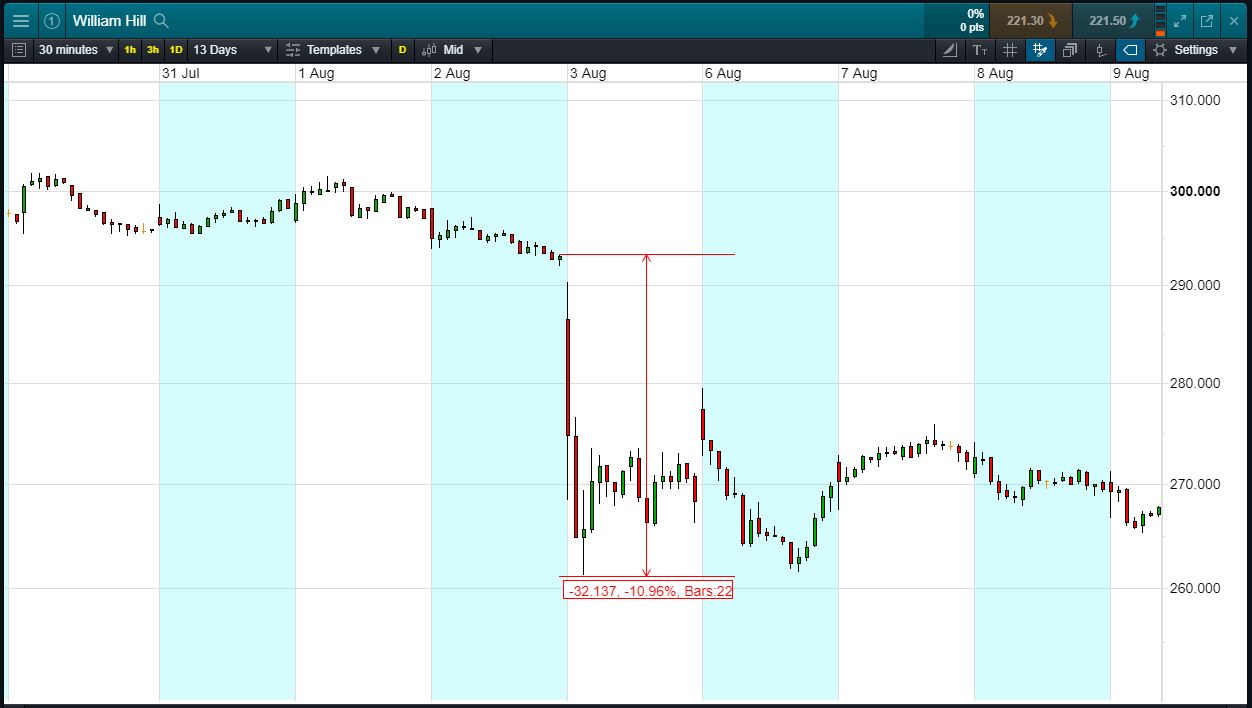

- The chart shows the price movement last time William Hill reported: H1 Results, 3 August.

- Shares opened -5.3p (-1.8%), rose as high as -2.5p (-0.9%) and fell as low as -30.6p (-10.5%, low of the day)

- The shares closed -23.7p (-8.1%) for a daily range of 28.1p or 9.6%.

- Shares -35.9% from 2018 highs; +15.2% from 2018 lows; -31.3% year-to-date.

- Recent share price range: Oct lows 192p; Sept highs 266p. Currently 221.4p (at time of writing).

- William Hill publishes Q3 Results on Tuesday, 6 Nov.

- Will we see another big move?

- Source: Bloomberg, FT, Reuters, DJ Newswires

Trading William Hill – An Example

Let’s say you think that William Hill results are likely to be good, and the share price is likely to rise. You decide to buy exposure to £10,000 worth of William Hill using CFDs, at the current price of 241.4p. To do this, you need £2,000.

For the purpose of this example, let’s assume William Hill reports strong results and the shares rise 10%. Your profit would be £1,000, from your initial investment of £2,000.

Conversely, let’s assume you open the position, and place a stop-loss 3% below the current price. William Hill results miss, it falls 3% and hits your stop-loss. Your loss would be £300.

This is provided for information purposes only. It should not be taken as a recommendation.