This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

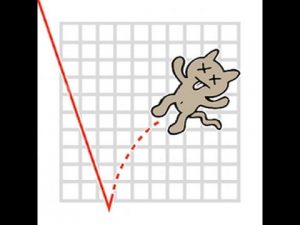

A ‘dead cat bounce’ can test even the most seasoned of traders. It’s all about making the right decision early and not letting greed get the better of you. This week it was the turn of Provident Financial (PFG) to demonstrate how the rebound from a very sharp drop can be extremely rewarding, but that it can just as quickly begin to unravel hence the adage that even a dead cat will bounce if it is dropped from a height.

Having fallen by a huge 75% on 22 Aug (from 1745p to 426.5p), financial markets discounting a hat-trick of bad news (profits warning, dividend withdrawal, CEO resignation) the shares rebounded by a mammoth 127% (to 971.5p) by 29 Aug. As is often the case, however, with the company’s prospects no longer what they were and city assumptions no longer valid, the shares refused to go any higher.

Since then the shares have eased by a whopping 20%, half of which this week. Not big numbers compared to the fall itself, and the rebound that ensued, but meaningful enough to penalise those late to the party, buying in anywhere near the top, greedily presuming the shares would simply keep rising.

As with all trading/investing, the bounce rewarded those brave enough to pounce when things looked their worst, echoing Baron Rothschild who said “The time to buy is when there’s blood on the streets”. He meant it literally in the aftermath of the Battle of Waterloo, but the principle holds. In the spirit of contrarian trading/investing; the worse things appear, the better the opportunitiy.

When a UK 100 (or even ) share price moves by more than 5% (up or down) our traders know about it instantly. And they will pass on the message to clients, giving them an opportunity to Buy, Sell, Sell Short or sit on their hands.

When PFG announced its bad news in an unscheduled 7am trading statement it was obvious there would be a negative reaction when trading began at 8am. A chunky 43% drop at the open – very rare for a UK Index bluechip – was thus no surprise. Our clients had had plenty of time to digest the news and put together a plan of action, assisted by our early price indications (from 7.50am the market trading order book made it clear that the shares were set for a very steep drop). This allowed them to decide which of four things to do;

To be in with a chance of getting your claws into the next example of this age old feline trading adage, get access to the research now to allow us at Accendo Markets keep you abreast of similar big share price moves that could generate you big profits. PFG has been added to a 2017 list of heavy fallers and rebounders that includes AstraZeneca, WPP, Carillion and Dixons Carphone to name but a few. There is sure to be another one soon. Make sure you’re in a position to profit.

As always, have a great weekend

Mike van Dulken, Head of Research, 8 Sept 2017

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research

Comments are closed.