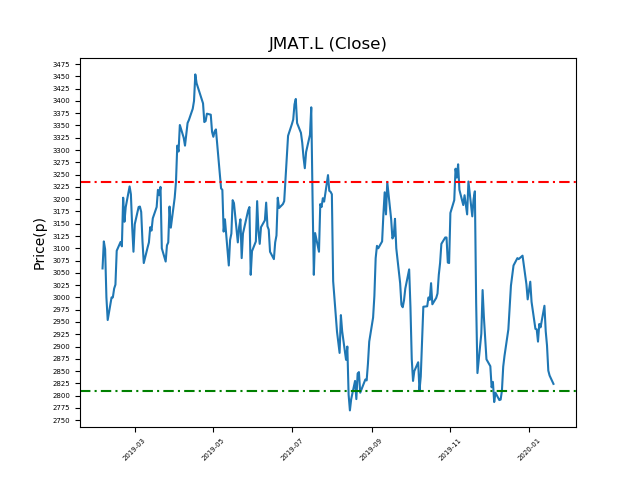

Johnson Matthey (JMAT.L) 20-01-20

Will Johnson Matthey (JMAT.L) shares break support, or will it continue within the current range and return to highs of 3235p? (+18%)

- Currently trading around the 2810p support at 2810p (at time of writing).

- The range has proven robust to date. Will the pattern repeat?

- The price has traded within this range for some time. However, traders should be mindful of stop-loss placement.

- Will the price continue in this range, bouncing once again to recent highs of 3235p? (+18%).

- Technical traders should be mindful of news and developments. Check our website and the press for updates.

- Shares -18% from 12-month highs; +1% from 12 month lows.

Latest News

28 Nov: JP Morgan Cazenove has downgraded its rating on Johnson Matthey (JMAT) to underweight (from neutral) and reduced the target price to 2850p (from 3400p).

27 Nov: Barclays Capital reiterates its equal weight rating on Johnson Matthey (JMAT) and reduced the target price to 3330p (from 3790p).

27 Nov: Liberum Capital reiterates its buy rating on Johnson Matthey (JMAT) and reduced the target price to 3500p (from 4400p).

25 Nov: Robert MacLeod, CEO, bought 5,250 shares in the firm on the 25th November 2019 at a price of 2841.60p. This Director currently has 64,172 shares.

25 Nov: Berenberg reiterates its buy rating on Johnson Matthey (JMAT) and reduced the target price to 3600p (from 3750p).

22 Nov: Deutsche Bank reiterates its buy rating on Johnson Matthey (JMAT) and reduced the target price to 3600p (from 3700p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires