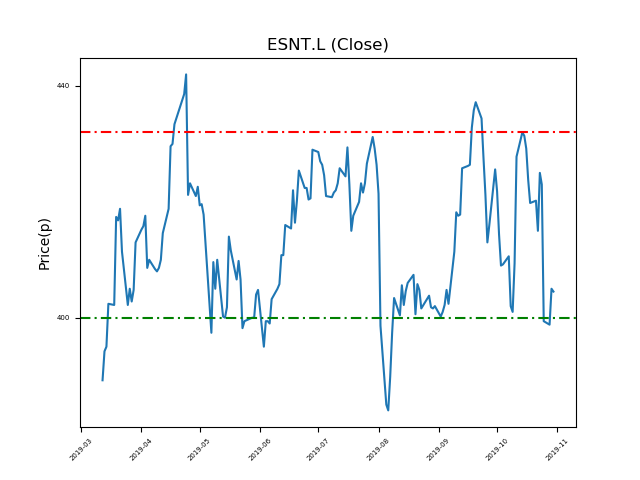

Essentra (ESNT.L) 30-10-19

Will shares break support, or will Essentra (ESNT.L) continue within the current range and return to the range highs at 432p? (+9%)

- Currently trading around the 400p support at 401.77p (at time of writing).

- The range has proven robust to date. Will the pattern repeat?

- The price has traded within this range for some time. However, traders should be mindful of stop-loss placement.

- Will the price continue in this range, bouncing once again to recent highs of 432p? (+9%).

- Shares -9% from 12-month highs; +23% from 12 month lows.

Latest News

25 Oct: Essentra, the plastic and fibre product supplier, announced that like-for-like revenue fell in Q3, due to a challenging wider economic environment along with some Brexit impact.

02 Aug: Essentra posted H1 profits 9.6% higher, thanks to increased revenues. Operating profit rose 9.6% to £48.3m.

24 Jul: Jefferies International has upgraded its rating on Essentra (ESNT) to buy (from hold).

12 Jul: Deutsche Bank reiterates its buy rating on Essentra (ESNT) and increased the target price to 445p (from 430p).

27 Jun: Essentra announced the acquisition of Innovative Components and Componentes Innovadores Limitada. The cost of the acquisition has not yet been disclosed.

20 Jun: Essentra has agreed to sell its speciality tapes business unit to OpenGate. The sale is worth $77m.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires