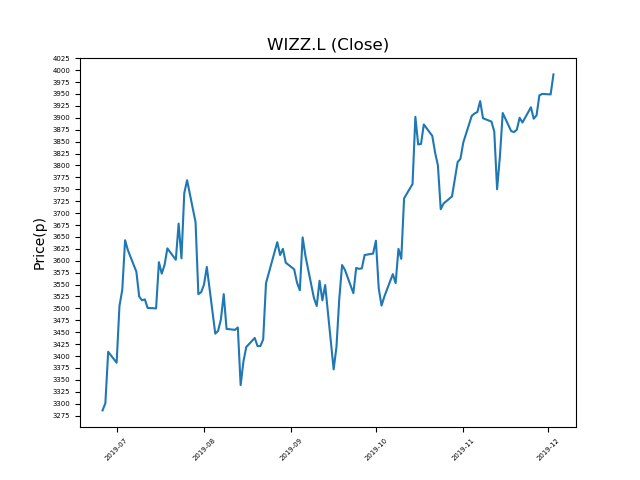

Wizz Air Holdings (WIZZ.L) 03-12-19

Will Wizz Air Holdings (WIZZ.L) continue this relentless rise, setting new highs?

- Currently trading at 3950.22p (at time of writing), performance has been exceptional of late.

- Will it hit resistance, or is the trend your friend?

- Is this one for momentum traders?

- The price has been moving upwards, however, past performance is not necessarily an indication of the future.

- Technical traders should be mindful of breaking news and events. This can influence price trends. Check our website and news outlets for updates.

- Shares -1% from 12-month highs; +45% from 12 month lows.

Latest News

07:05: Wizz Air, the low-cost airline, announced that it carried 24% more customers in November on-year, after it opened new routes in Lithuania, Poland, Georgia, Hungary and Ukraine.

25 Nov: Barclays Capital reiterates its overweight rating on Wizz Air Holdings Plc (WIZZ) and increased the target price to 4380p (from 3450p).

14 Nov: JP Morgan Cazenove reiterates its overweight rating on Wizz Air Holdings Plc (WIZZ) and increased the target price to 4700p (from 4300p).

14 Nov: HSBC reiterates its hold rating on Wizz Air Holdings Plc (WIZZ) and increased the target price to 3500p (from 3250p).

13 Nov: Wizz Air posted a 91% boost in H1 profits. Higher ticket and ancillary revenue drove performance, despite an increase in fuel costs.

18 Oct: HSBC reiterates its hold rating on Wizz Air Holdings Plc (WIZZ) and increased the target price to 3250p (from 3100p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires