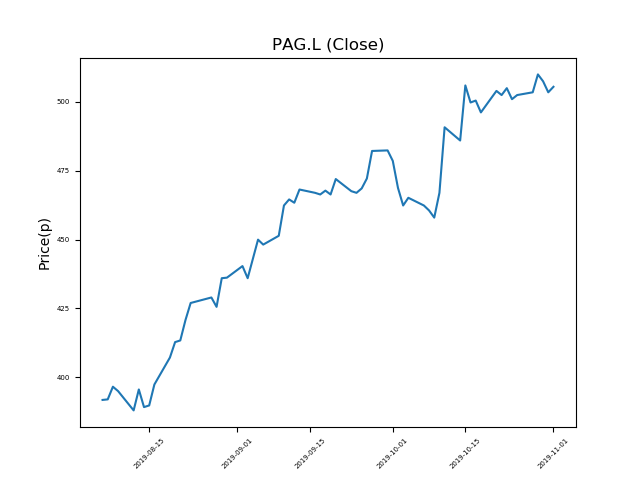

Paragon Banking PLC (PAG.L) 01-11-19

Will Paragon Banking PLC (PAG.L) continue to rise?

- Now trading at 504p (at time of writing), the share price momentum has been strong.

- Is this trend your friend?

- Could this appeal to momentum investors?

- Whilst the trend has been strong, remember that past patterns are not necessarily an indication of the future.

- Be mindful of new events and the influence they can have on price action. Check regularly for updates.

- Shares -1% from 12-month highs; +32% from 12 month lows.

Latest News

29 Aug: RBC Capital Markets has upgraded its rating on Paragon Banking Group PLc (PAG) to sector performer (from underperform) and increased the target price to 445p (from 400p).

19 Aug: Peel Hunt reiterates its buy rating on Paragon Banking Group PLc (PAG) and increased the target price to 580p (from 485p).

23 Jul: Paragon Banking Group, the specialist lender, announced that the size of its mortgage and commercial lending books had continued to grow. Its net interest margins continued to improve.

20 Jun: RBC Capital Markets has downgraded its rating on Paragon Banking Group PLc (PAG) to underperform (from sector performer) and reduced the target price to 410p (from 440p).

22 May: Paragon Banking Group posted an 8.7% growth in underlying H1 profit on improved income. Profit for the year fell to £72.0m, declining from £77.2m.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires