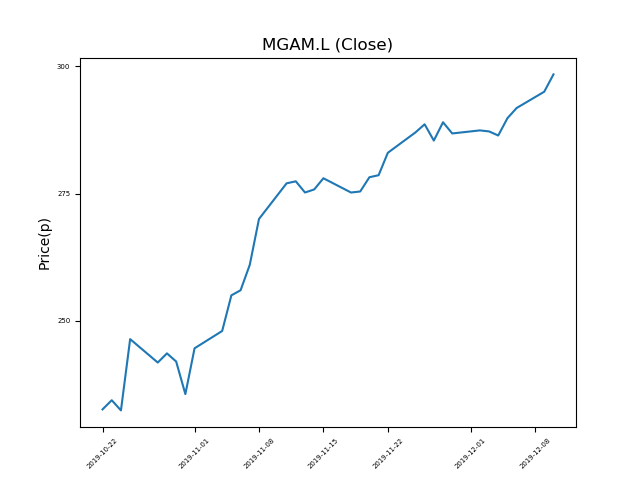

Morgan Advanced Materials (MGAM.L) 10-12-19

Will shares in Morgan Advanced Materials (MGAM.L) continue to rally, setting new recent highs?

- Now trading at 295.9p (at time of writing), the price performance has been very strong.

- Will it come to an end, or is this trend your friend?

- Whilst momentum has been strong, traders should remember that past performance is not necessarily an indication of the future.

- Shares -0% from 12-month highs; +27% from 12 month lows.

Latest News

08 Nov: Morgan Advanced Materials, the specialist manufacturer, announced that operating margins and underlying sales were slightly better in the nine months to date.

09 Oct: RBC Capital Markets has downgraded its rating on Morgan Advanced Materials (MGAM) to underperform (from sector performer).

24 Jul: Jefferies International has upgraded its rating on Morgan Advanced Materials (MGAM) to buy (from hold) and reduced the target price to 320p (from 365p).

22 Jul: Berenberg reiterates its buy rating on Morgan Advanced Materials (MGAM) and reduced the target price to 330p (from 360p).

24 May: Pete Raby, Director, sold 59,088 shares in the firm on the 23rd May 2019 at a price of 252.69p. This Director currently has 134,822 shares.

24 May: Peter Turner, Executive Director, has transferred in 102,619 shares in the firm on the 23rd May 2019. This Director currently has 242,619 shares.

24 May: Peter Turner, Executive Director, sold 48,289 shares in the firm on the 23rd May 2019 at a price of 252.69p. This Director currently has 194,330 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires