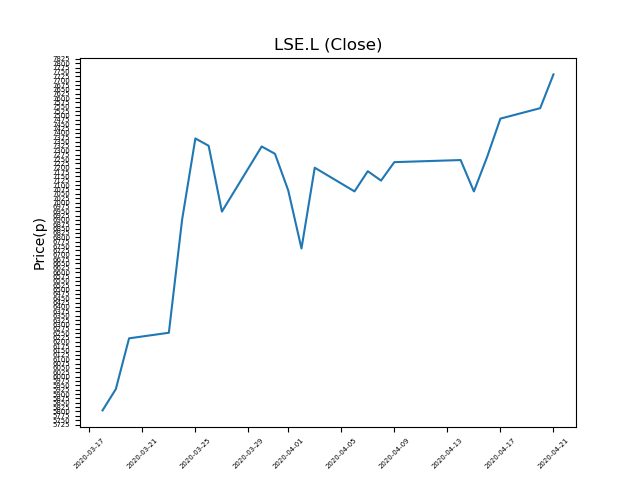

London Stock Exchange (LSE.L) 21-04-20

London Stock Exchange (LSE.L) has continued to rally strongly, setting new recent highs. Will the momentum persist?

- Now trading at 7620p (at time of writing), momentum has been robust.

- Will it end, or is this trend your friend?

- Is this the opportunity for momentum traders?

- Momentum has been robust, but traders should remember that past performance is not always an indication of the future.

- Technical traders should be mindful of breaking news. It can influence price action. Check our website for updates.

- Shares -10% from 12-month highs; +52% from 12 month lows.

Latest News

20 Apr: Berenberg reiterates its buy rating on LSE Group (LSE) and increased the target price to 8490p (from 8115p).

09 Apr: Deutsche Bank reiterates its hold rating on LSE Group (LSE) and reduced the target price to 7400p (from 7700p).

31 Mar: Credit Suisse reiterates its outperform rating on LSE Group (LSE) and reduced the target price to 7590p (from 8340p).

16 Mar: LSE announced that US foreign investment regulators had approved its proposed takeover of Refinitiv, the financial information company, for $27bn.

10 Mar: David Warren, Executive Director, exercised 9,677 shares within the firm on the 10th March 2020. This Director currently has 147,878 shares.

10 Mar: David Warren, Executive Director, sold post-exercise 4,556 shares within the firm on the 10th March 2020 at a price of 7406p. This Director currently has 143,322 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires