Results season is upon us again. Time for a refresher on corporate lingo. Management verbiage can be a minefield for retail investors. Next time you read about business performance, I hope this will make things clearer. Sales, revenues and profits sound so very impressive when described in their millions, if not billions. But what’s more…

The piece I wrote on Support last week was well received, thanks to the range of charts I used, which bounced 2-12%. So I’ll continue the theme by revisiting another retail investor favourite: Fallers. If you’re expecting a list of names which fell sharply this week and could be due a bounce, you’re out of luck. I’ve…

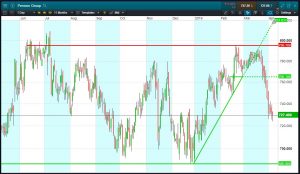

Since the 1st of Jan the UK 100 is up 900 points, from lows of 6,500 to current highs of 7400. In one of the best starts to the year for a decade…Brexit? What Brexit?! 47% of UK 100 members have risen in excess of 10%. One sector which has had a stellar first quarter: Mining. All…

The UK 100 index has bounced off the floor of its 3-month up-channel. This comes thanks to fresh GBP weakness, driven by uncertainty about Brexit. If the PM fails to push her deal through Parliament, to delay Brexit until May, and another round of indicative votes on Monday fail to deliver a Commons consensus, the…

I have sat with many a client over the years, mostly discussing charts. I try and boost their confidence in reading share price activity for trading signals. Are the shares going higher, or are they headed lower? What they always want to know is how to draw trend-lines. Because everyone wants to profit from the next…

Whether watching TV or browsing the web/social media you can’t avoid the latest Brexit headlines. This has seen many retail investors shy away from the markets. But at what cost? How to you plan to bank any profits? Every day I hear, “it’s all so uncertain” or “I’ll wait and see what happens”. My first thought…