13 October 2015 This week’s major London IPOs have had mixed fortunes. Payments processing giant Worldpay (WPG) managed to list this morning at 240p, right in the sweet spot…

9 October 2015 The UK 100 is on course for its best week in almost 4 years (+5%) having rebounded 10% from September lows and there’s potential for a return to April’s 7000. After the sharp August sell-off and the index trading with a ‘5’ in front for 6 weeks, to be able to discuss…

9 October 2015 Following our most recent marketing report (Top 10 Stocks for Q4) in the wake of the steep summer sell-off, and thanks to big rebounds by many big names we have had a slew of client requests about ‘which stocks are trading closet to all-time lows?’ Due to some companies being listed for…

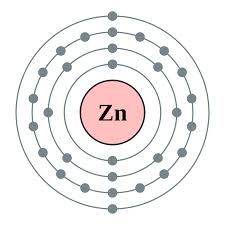

9 October 2015 Glencore (GLEN) shares topping the UK Index this morning, helped by rising commodity prices after dovish Fed minutes weakened the USD (notably Oil and copper) but more importantly by GLEN’s decision to leave a load of Zinc in the ground. After years of commodity-wide over-investment on high prices now resulting in supply…

7 October 2015 UK Index listed Airlines (IAG, EZJ, RYA, WIZZ) continue to lose altitude today (down 2-3%) as investors react to oil’s extended bounce to the longest in nearly six months. Note US Crude back around $49.6/barrel late Aug highs and Brent around the $53 mark last seen 3 September. The move out of…

29 September, 2015 Wolseley (WOS) has taken the UK Index wooden spoon from Glencore this morning, with investors sending the shares back to May lows in response to FY results a touch below City expectations even if they confirm long-term turnaround under CEO Meakins.Nonetheless, investors are demonstrating cold-bloodedness, concerned at ‘markets remaining challenging’ outside the…