BP

Is this breakout a good trade for you?

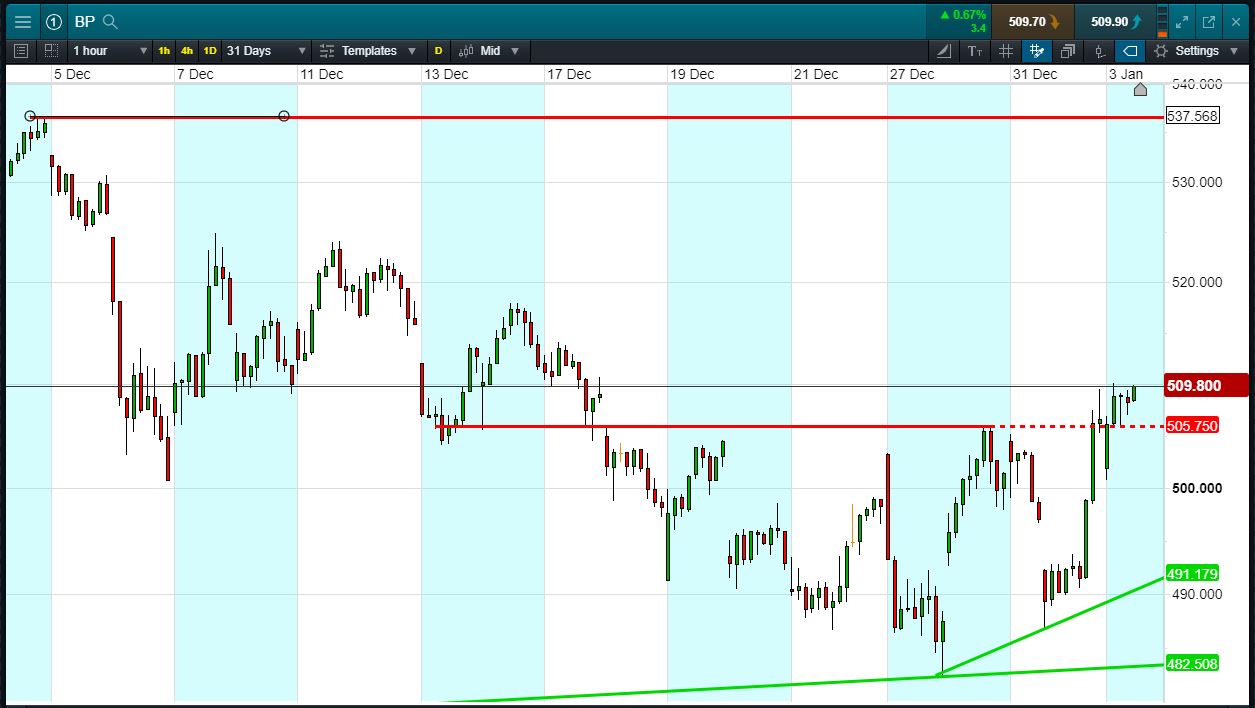

Will BP turn, or will it continue towards 537p highs?

- The chart shows the last month’s price action for BP.

- The shares have broken above a resistance line at 506p to trade 510p (at time of writing).

- The ‘trend is your friend’. Will it continue?

- Shares -15.9% from 2018 highs; +12.1% from 2018 lows; +2.8% since end-17.

- 19 Dec: Reuters suggests BP looking to sell $3bn in US Onshore Oil & Gas assets

- Source: Bloomberg, FT, Reuters, DJ Newswires, AlphaTerminal

Trading BP – An Example

Let’s say the breakout appeals to you, you think it’s likely to continue. You decide to buy exposure to £10,000 worth of BP using a CFD, at the current price of 510p. To do this, you need £2,000.

Let’s assume the BP trend continues upwards to 537p (+5.3%). Your profit would be £530, from your initial investment of £2,000.

Conversely, let’s assume you open the above position, and place a stop-loss at 2% from the current price. BP breaks down, falling 2% and it hits your stop-loss. Your loss would be £200.

This is provided for information purposes only. It should not be taken as a recommendation.