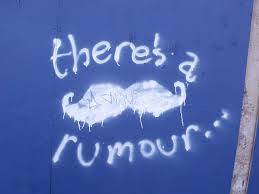

Yesterday was a textbook example of the trading phenomenon known as “buy the rumour; sell the fact”. Oil cartel OPEC did what was widely expected, extending production cuts by another 9 months to support oil prices in the face of rising US production. However, oil prices sold-off 6%, erasing some of their recent 17% bounce….

Shares in Restaurant Group (RTN) are top of the this morning, up 9.5% for a bullish test of May highs and major moving averages. This means the shares have recovered nearly almost all of the ground lost since a mid-month sell-off began, kicked off by fresh uncertainty about US President Trump and global growth, and…

Macro observations After the exciting (if not concerning) week that was, foreign exchange markets have begun the new week on a much calmer note. However, with underlying drivers remaining in place, we await the next spark to ignite the political flames. In US politics, President Trump’s tour of the Middle East has helped to allay…

26 May Telegraph Mike van Dulken, head of research at Accendo Markets, said the trading update would “put investors at ease regarding full year profits, management being able to reiterate guidance despite 2017 being a transitional year requiring investment and with a new chief at the helm”. http://www.telegraph.co.uk/business/2017/05/26/sales-slip-restaurant-group-amid-turnaround-plan/ 25 May Armchair trader Accendo Markets Analyst,…

Investors long of oil breathed a collective sigh of relief this week as prices extended their rebound from 9% to 14%, having fallen 18% from mid-April to early May (fresh 6-month lows). With US crude back at $50/barrel and Brent Crude at $53.5, we spy positive technical trading signals that bode well ahead of what…

In a week that threw up just about as many twists and turns as you can shake a stick at, there was one shining light that many investors took stock of. In a break from the political circus of the general election, the UK government announced that Lloyds has finally returned to full privatisation, putting to…