This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

The strongest factors influencing the direction and momentum of the FX rate are major macroeconomic indicators, chief among them the changes in the key interest rates. Higher interest rates make the currency more attractive and lead to a stronger currency.

In the UK, interest rate policy is determined by the Bank of England’s (BoE) Monetary Policy Committee (MPC), which meets several times a year and whose decisions are closely watched by all FX traders.

In the US, key interest rate decision-making body is the Fed’s Federal Open Market Committee (FOMC), while in the Eurozone it is the ECB’s Governing Council.

Other key factors influencing FX rates are macroeconomic data on inflation, economic growth and wages.

The following events this week could have a major impact on FX markets.

GBP

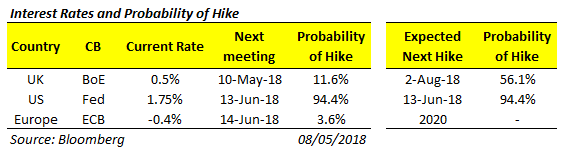

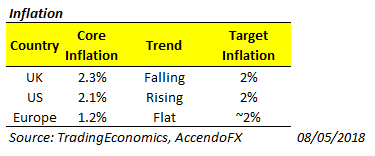

Main GBP driver this week will be BoE’s monetary policy meeting that is expected to leave current key interest rates unchanged at 0.5% (only 11.6% rate hike probability) (Source: Bloomberg, see table above). This is based on dovish comments in late April from Bank Governor Mark Carney that remarked on lower than expected wage growth, soft inflation and poor retail data, which analysts took to mean that no imminent rate hike should be expected.

Thursday, May 10 meeting will see release of Inflation Report Publication that could give an indication of the Bank’s thinking for future policy changes.

Brexit cabinet committee will convene on Wednesday, May 9, to discuss PM Theresa May’s compromise plan for a so-called “customs partnership”. With strong opposition within the cabinet, this meeting will be a tough test for PM’s ability to push her Brexit agenda, adding extra pressure to the already-embattled GBP.

EUR

Key Eurozone data this week will come from on Wednesday, May 9, with the publication of Germany’s March trade and production figures.

This trade data could help explain disappointing Eurozone growth figures from last week, with weaker than expected trade data putting pressure on the EUR.

USD

Major USD influencer this week will be the Thursday, May 10 release of US Inflation data, as well jobs reports. With US employment expected to see further decrease, this could extend USD advance to new 2018 highs.

Other key data this week will be China’s trade balance, imports and exports figures on Tuesday, May 8.

If China reports another large surplus, this would increase their FX holdings, giving China additional power to put downward pressure on the USD through further purchase of US Treasuries.

(Sign up here to receive our daily live macro-calendar)

15:30 DOE Crude Oil Inventories (US)

00:01 April RICS House Price Balance (UK)

09:30 Industrial Production (UK)

02:30 Inflation (China)

12:00 Bank of England Rate Decision/Inflation Report

13:30 Inflation, wage growth (US)

15:00 U. of Mich. Sentiment (US)

Technicals

Technicals

Technicals

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research

Comments are closed.