This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

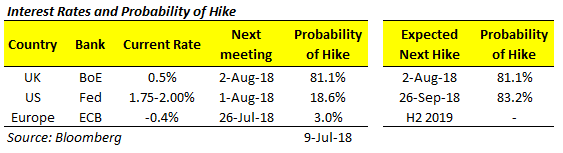

The strongest factors influencing the direction and momentum of Foreign Exchange (FX) rates are changes in the key interest rates, themselves highly sensitive to macroeconomic data such as inflation and economic growth, as well as geopolitical concerns. Higher interest rates tend to render the currency more attractive (and vice versa) which, in turn, can result in it strengthening versus other currencies.

In the UK, interest rate policy is determined by the Bank of England’s (BoE) Monetary Policy Committee (MPC), which meets several times a year and whose decisions are closely watched by all FX traders, but especially those trading Pound Sterling (GBP).

In the US, the key interest rate decision-making body is the Federal Reserve’s (Fed) Federal Open Market Committee (FOMC), influencing the US Dollar (USD), while for the single currency Euro (EUR) in the Eurozone, it is the European Central Bank (ECB).

The following events this week could have a major impact on FX markets.

GBP

PM Theresa May has brought her Brexiteer colleagues in line, averting a potential cabinet coup and giving more resilience to the Pound, but many questions remain unanswered regarding the nature of her final Brexit solution. The resignation of Brexit secretary David Davis is adding to the turmoil (could more Brexiteers be on their way out?), but the removal of a major impediment to a pro-business “soft Brexit” is seen as a positive for the Pound. Keep in mind, though, that recent GBP strength could be in danger this week if EU negotiators in Brussels reject the new proposals out of hand.

In terms of indicators, keep a close eye on UK Trade figures (Tue, 9:30am). May’s trade imbalance is expected to narrow to £3.4b from a massive £5.3b deficit the previous month, though still continuing a negative trend this year.

In a retreat from standard global practice, the UK will begin publishing monthly GDP statistics, starting with May estimate (Tue, 9:30am). The usual quarterly data will still be released (as a rolling 3-month figure), but the Office of National Statistics (ONS) is now moving to more timely and accurate monthly economic growth updates. The new figures are expected to show UK economic growth close to zero in the Feb-Apr period, but improving in Mar-May.

The switch to a new statistical system will offer more up-to-date information for policy-makers, though the initial roll-out could prove troublesome for the BoE, which was relying on quarterly government statistics to provide some justification for its future interest rate hike. If no full Q2 UK GDP numbers are published before the MPC’s 2 August meeting, will the central bankers instead chose to postpone the rate hike until more growth data is available?

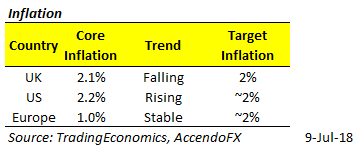

While the BoE is now increasingly hawkish, it would prefer to justify the hike to the public by pointing to a Q2 economic rebound. Another delay in base rate increase could spell short-term trouble for GBP. Monthly GDP updates could also increase Sterling volatility as markets will be adapting their expectations to new data more often.

In the final piece of important data this week, pay attention to the BoE’s Q2 Credit Conditions and Bank Liabilities Survey (Thurs, 9:30am). While critical for equity markets (i.e. UK Index Banks), takeaways from this survey could also impact FX markets by indicating levels of credit availability to UK households, as well as demand for lending. This data has some inflationary read-across and a more confident BoE report could bolster GBP.

EUR

Germany is commanding the single currency’s attention on the data front this week. FX traders will be looking to important German ZEW Surveys (Tue, 10am), with economic sentiment in Europe’s largest economy continuing to worsen. Economists are projecting another drop in the sentiment indicator, for a 4th straight month of negative data (driven largely by trade war worries and weak economic growth).

These figures could be echoed by Germany’s final June Consumer Price Inflation (Thurs, 7am), also expected softer both MoM (est. 0.1% down from 0.5%) and YoY (est. 2.1% down from 2.2%). The week is not looking good for EUR on the macroeconomic side of things, though better than expected data could always provide a surprise boost to the single currency.

The ECB Governing Council will be meeting this Wednesday. While the meeting itself is not directly concerned with monetary policy, FX traders will still be paying close attention to any statements coming from high-profile participants about the direction of the ECB policy (i.e. QE, interest rates, Eurozone fiscal rules). Likewise, minutes from the previous ECB monetary policy meeting (Thurs, 12:30pm) will be watched for hints on policy direction.

On the geopolitical side of things, NATO Summit will take place in Brussels on Thursday. Outside of the summit’s nominal military dimension, the meeting will once again pit President Trump against his European and North American allies, with trade and tariffs a potential topic for discussion. With sparks flying after the last time such a confrontation happened at the G7 meeting in Canada, both EUR and USD pairs could take some hits.

USD

News of tit-for-tat trade war sanctions between US, Europe and China are driving many FX traders out of traditional EUR/USD and EUR/GBP crosses and into safer haven of USD/JPY. With the first salvo between US and China fired last week, FX markets are back to playing the waiting game. News of additional trade tariffs this week could do additional damage to USD pairs. While some of tariff back-blast is already priced in, the unpredictable nature of the tariff war could further weaken USD, so keep an eye on the trade headlines.

In macroeconomic data, pay attention to US consumer price inflation (Thurs, 1:30pm). Expectations are calling for unchanged MoM June reading (0.2%), but a slight YoY acceleration in both headline (2.8% to 2.9%) and core metrics (2.2% to 2.3%). With the Fed coming out with a relatively hawkish outlook in the latest FOMC Minutes, FX markets are already expecting a strong price growth number. With that in mind, a disappointing reading could depress the USD more than usual.

As a follow-up, keep a close eye on University of Michigan consumer confidence numbers (Fri, 3pm). USD should get some much needed support there, as economists are expecting a slightly firmer July reading to continue a 3-month uptrend, though consumer confidence is still off 2018 highs seen in March.

(Sign up here to receive our daily live macro-calendar)

Tuesday 10 July

Major UK Economic Data

00:01 BRC Retail Sales

09:30 Trade Balance, Monthly GDP

Major Intl Economic Data

10:00 ZEW Surveys (Germany)

Wednesday 11 July

Major Intl Economic Data

13:30 Producer Price Inflation (US)

15:00 Wholesale Sales & Inventories (US)

Thursday 12 July

Major UK Economic Data

00:01 RICS House Price Balance

09:30 BoE Credit Conditions Survey

Major Intl Economic Data

07:00 Consumer Price Inflation (Germany)

10:00 Industrial Production (Eurozone)

13:30 Consumer Price Inflation, Wages (US)

Friday 13 July

Major Intl Economic Data

04:00 Import/Exports/Trade (China)

13:30 Import/Export Price Inflation (US)

15:00 Consumer Sentiment (US)

Technicals

Technicals

Technicals

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance.

Prepared by Michael van Dulken, Head of ResearchComments are closed.