Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

UK 100 called to open -5pts, despite Asian markets positive following an improvement in the official Chinese Manufacturing PMI figure to growth territory and the HSBC figure (still in contraction) hitting 8-month highs. This has kept equities in Shanghai buoyant after recent central bank (PBOC) liquidity injections and macro data suggesting things may be picking up again after growth slowed.

Australia is lagging considerably after its Export Price Index fell (as expected) significantly in Q3 and its Manufacturing PMI remained well into contraction territory. The data highlights the slowing growth from China, Asia and globally, and highlights Australia’s reliance on exports.

Overnight, note the UK’s CBI upgrading its economic forecasts not expecting the Bank of England (BoE) to announce further quantitative easing (QE) next week. The CBI now expects GDP to be flat in 2012 (prev -0.3%) and 2013 to deliver growth of 1.4% (prev 1.3%). UK Nationwide House Prices this morning have come in quite a bit better than expected.

US markets, reopening after Hurricane Sandy lead to their longest weather-related closure in 125 years, saw equities mixed, but sentiment weighed down by Apple, whose shares were weak on recent management changes. The limited US macro data was also disappointing, with Chicago PMI falling back into contraction and neighbouring Canada’s August GDP much weaker.

Ahead of Friday’s big one – US Non-Farm Payrolls (NFP) – news that ADP, whose employment change figure (today) is often seen as a warm up act, had significantly revised down its September print due to a new methodology dented confidence, given unemployment’s links to consumer confidence and now explicit links to the Fed’s QE3.

Much talk (progress versus denials) continues on Greece with EU officials saying progress on budget cuts had been made in order to get its next tranche of aid, although nothing agreed with Troika of bailout lenders yet. Discussions also taking place about a debt buy-backs involving both the private sector and central banks and possible extensions of debt maturities and deficit targets.

On Spain, hopes of a bailout continue to fade and its beleaguered banking sector is back to the fore with news that four regional savings banks (Cajas) may need state aid after being refused assistance by the European commission and the Spanish central bank.

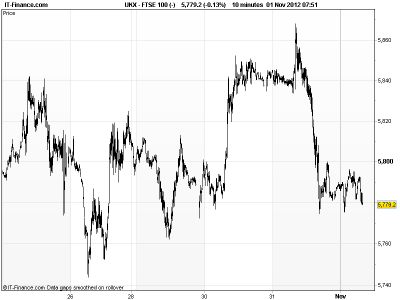

The UK flagship index has fallen below its 4-day rising trendline of support which could revert to resistance at 5,815 and hinder any advances. Downside support at 5,740 from Friday’s lows, although yesterday’s lows of 5,775 held overnight.

In FX, GBP/USD maintains its upward momentum and has now broken through the 1-month trendline of falling resistance at 1.61 This could no revert to support and help with any gains towards recent highs of 1.63, especially if BoE doesn’t announce any more QE next week and US employment data supports QE3 requirements for a good while longer. EUR/USD weakened back after its break of falling resistance and regaining of the 1.30 level after Eurozone concerns were revived. Trendline to serve as support at 1.29?

In commodities, Gold is edging higher at$ 1721, helped by a slightly weaker USD but resistance possible around $1730, as it was resistance early last week following a break of support there the prior week. US Crude Oil and Brent Crude Oil continue to trade sideways. Around $86 and 108 respectively..

Q3 results out this morning from Lloyds Banking Group (LLOY) look to have missed at the EPS level, although as always with the banks the devil is in the detail and the figure more likely to be concentrated on today will be the additional £1bn provision for PPI mis-selling. Royal Dutch Shell (RDSa) looks to have beaten expectations and raised its dividend, while BT (BT.A) has cut revenue guidance. BSkyB (BSY) results show strong Q1 earnings growth helped by price rises and sale of additional products to existing customers, offsetting lacklustre performance in signing up new customers.

In focus today will be the UK’s PMI Manufacturing which is seen falling back a touch and remaining in contraction. US Jobs data (Challenger, ADP and Weekly Jobless) will again be keenly watched, especially after the change in methodology for ADP and ahead of tomorrow’s NFP. Weekly jobless seen flat. US Consumer confidence seen ticking up in October. US PMI and ISM seen around 51.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Aussie Manufacturing PMI Improved, but still in contraction

- Aussie Export Price Index In-line

- Aussie Import Price Index Better

- China PMI Manufacturing In-line

- China HSBC PMI Manufacturing Improved, but still in contraction

- Japan Vehicle Sales Still in decline

- UK House Prices Beter

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Glencore sees “healthy improvement” in marketing in Q3

- Chemring warns on full-year profit

- Soco says production soars in 2012

- Croda Q3 underlying group sales up 3.2 pct

- BT cuts full-year revenue outlook

- BSkyB posts strong first quarter earnings

- L&G says Q3 sales up 28 percent

- Shell Profit Falls 6% On Weaker Oil, Gas Prices, Lower Chemicals Margins

- Lloyds Banking Pushed to Loss as PPI Claims Mount