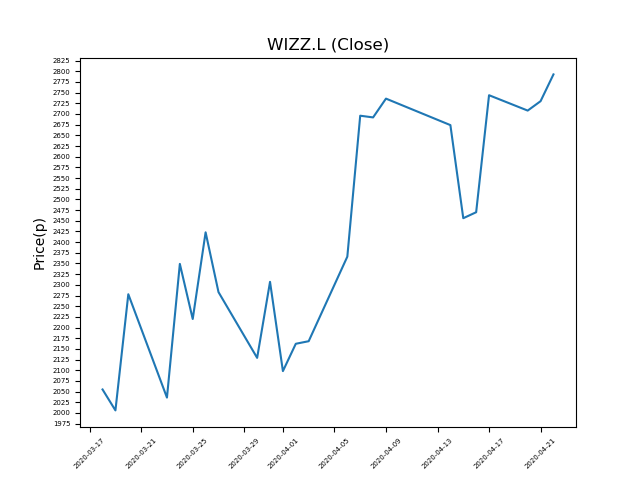

Wizz Air Holdings (WIZZ.L) 22-04-20

Will shares in Wizz Air Holdings (WIZZ.L) continue to rally, setting new recent highs?

- Now trading at 2790p (at time of writing), the share price performance has been very strong.

- Will it end, or is this trend your friend?

- Could this be the ideal opportunity for momentum traders?

- Whilst momentum has been strong, traders should remember that past performance is not necessarily an indication of the future.

- Technical traders should consider of new events, which can influence price action. Check our website and news outlets for updates.

- Shares -37% from 12-month highs; +39% from 12 month lows.

Latest News

21 Apr: Wizz Air, the budget airline, announced it had been given affirmation that it was an eligible issuer under a United Kingdom government facility intended to help businesses during the coronovirus pandemic.

14 Apr: Wizz Air announced it was making 1,000 redundancies and planned to return 32 older leased aircraft. The majority of its aircraft have been grounded due to the coronovirus pandemic.

02 Apr: The coronovirus pandemic has forced Wizz Air to lower capacity by 34% (year-on-year) for March.

18 Mar: HSBC has upgraded its rating on Wizz Air Holdings Plc (WIZZ) to buy (from hold) and reduced the target price to 2800p (from 3200p).

18 Mar: William Franke, Chairman, bought 30,000 shares within the firm on the 17th March 2020 at a price of 2355p. This Director currently has 15,187,667 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires