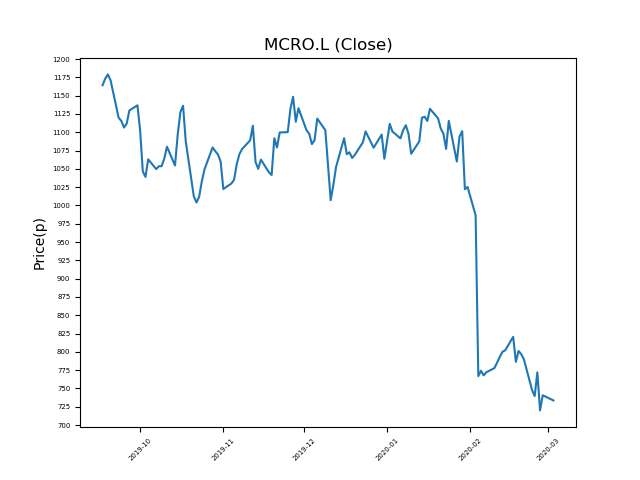

Micro Focus International (MCRO.L) 03-03-20

Micro Focus International (MCRO.L) has dropped from highs of 1179p. Will it continue, or could you pick up a bargain?

- Now trading at 729.9p (at time of writing). A return to period highs would mean a rise of 61%.

- This shares are amongst the most significant fallers in the period.

- Markets constantly over-react to adverse news. Traders should consider whether the fall is reasonable, or is this another over-reaction?

- Bargain hunters should be mindful of the underlying fundamentals.

- Shares -70% from 12-month highs; +1% from 12 month lows.

Latest News

24 Feb: Citigroup reiterates its sell rating on Micro Focus International (MCRO) and reduced the target price to 680p (from 1000p).

20 Feb: UBS has downgraded its rating on Micro Focus International (MCRO) to neutral (from buy) and reduced the target price to 810p (from 1530p).

19 Feb: Micro Focus International, the software company, initiated a $1.44bn refinancing of its debt and extended its $500m credit facility.

07 Feb: Kevin Loosemore, Chairman, bought 64,400 shares within the firm on the 6th February 2020 at a price of 763.28p. This Director currently has 1,012,551 shares.

07 Feb: Kevin Loosemore, Chairman, bought 64,400 shares within the firm on the 6th February 2020 at a price of 763.28p. This Director currently has 1,076,951 shares.

06 Feb: Credit Suisse reiterates its underperform rating on Micro Focus International (MCRO) and reduced the target price to 630p (from 990p).

05 Feb: Jefferies International reiterates its hold rating on Micro Focus International (MCRO) and reduced the target price to 800p (from 1300p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires