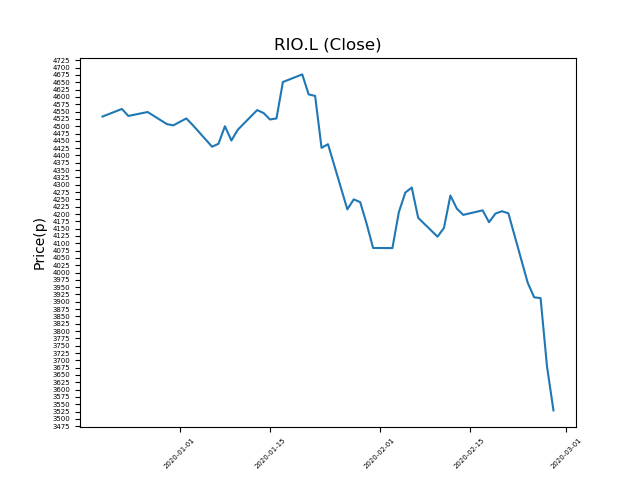

Rio Tinto (RIO.L) 28-02-20

Shares in Rio Tinto (RIO.L) have fallen dramatically from recent highs of 4677p. Will it continue, or is this an opportunity to pick up a bargain?

- Now trading at 3501.5p (at time of writing). A return to previous highs would represent a rise of 33%.

- This stock is one of the most significant fallers in the period.

- Is the trend your friend, or is a bounce imminent?

- The market often over-reacts to bad news. Traders should consider whether it is down for good reason, or is this another over-reaction?

- Bargain hunters should be mindful of fundamentals and events, which can influence price action. Check our website and news outlets for updates.

- Shares -29% from 12-month highs; +0% from 12 month lows.

Latest News

27 Feb: JP Morgan Cazenove reiterates its neutral rating on Rio Tinto (RIO) and reduced the target price to 4830p (from 4890p).

27 Feb: Deutsche Bank reiterates its hold rating on Rio Tinto (RIO) and reduced the target price to 4400p (from 4450p).

26 Feb: Rio Tinto, the mining group, posted a 41% decline in profits for the year and cautioned that coronavirus could impact its supply chains in the near-term.

21 Feb: Rio Tinto announced it had installed three new non-executive directors.

18 Feb: Rio Tinto announced it had supplied a feasibility assessment to authorities in Mongolia. The intention is to build a $924m power plant to supply the Oyu Tolgoi copper mine in the country (currently being proposed).

17 Feb: Rio Tinto downgraded its annual iron ore supply estimates after a tropical storm damaged infrastructure in Western Australia.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires