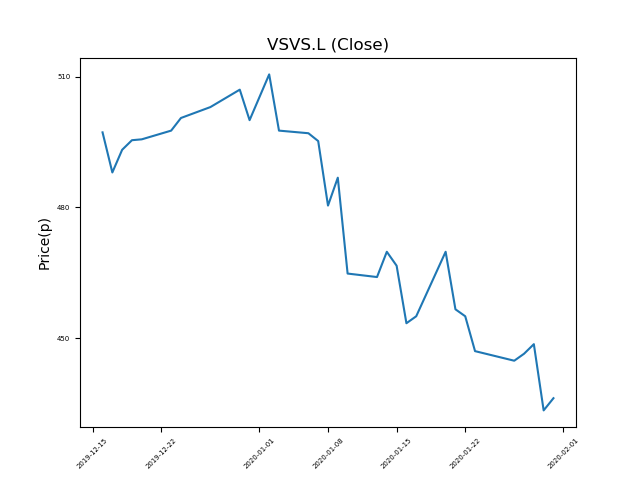

Vesuvius (VSVS.L) 31-01-20

Vesuvius (VSVS.L) shares have fallen significantly from the most recent highs of 510.5p. Will it continue, or is this an opportunity to pick some up?

- A return to previous highs would represent a rise of 17%. Now at 433p (at time of writing).

- This is one of the biggest fallers of late.

- Traders should consider whether it is down for good reason, or is this another over-reaction?

- Bargain hunters should be mindful of fundamentals and events, which can influence price action. Check our website and news outlets for updates.

- Shares -32% from 12-month highs; +27% from 12 month lows.

Latest News

20 Jan: Berenberg reiterates its buy rating on Vesuvius (VSVS) and increased the target price to 565p (from 485p).

20 Jan: Barclays Capital today initiates coverage of Vesuvius (VSVS) with a equal weight rating and target price of 495p.

20 Nov: Berenberg has upgraded its rating on Vesuvius (VSVS) to buy (from hold) and reduced the target price to 485p (from 520p).

01 Nov: Jefferies International reiterates its buy rating on Vesuvius (VSVS) and reduced the target price to 605p (from 690p).

30 Oct: Goldman Sachs reiterates its neutral rating on Vesuvius (VSVS) and reduced the target price to 480p (from 560p).

16 Oct: JP Morgan Cazenove reiterates its overweight rating on Vesuvius (VSVS) and reduced the target price to 593p (from 683p).

16 Oct: Peel Hunt reiterates its buy rating on Vesuvius (VSVS) and reduced the target price to 600p (from 715p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires