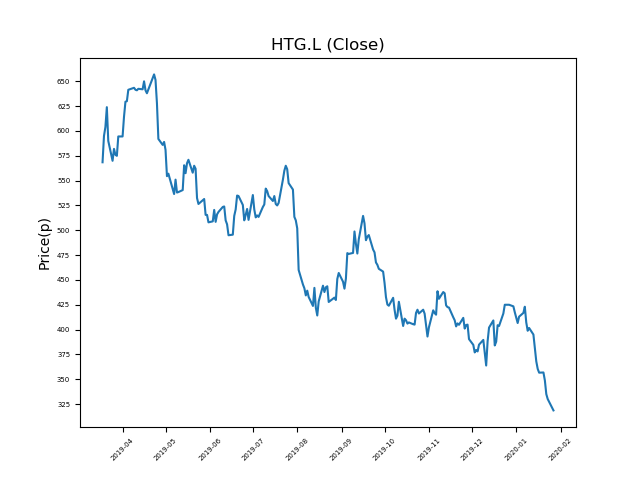

Hunting (HTG.L) 28-01-20

Shares in Hunting (HTG.L) have fallen dramatically from recent highs of 657p. Will it continue, or is this an opportunity to pick up a bargain?

- Now trading at 316.4p (at time of writing). A return to previous highs would represent a rise of 107%.

- This stock is one of the most significant fallers in the period.

- Is the trend your friend, or is a bounce imminent?

- The market often over-reacts to bad news. Traders should consider whether it is down for good reason, or is this another over-reaction?

- Bargain hunters should be mindful of fundamentals and events, which can influence price action. Check our website and news outlets for updates.

- Shares -51% from 12-month highs; +0% from 12 month lows.

Latest News

23 Jan: Hunting, the energy services company, announced that finance director, Peter Rose, would step down from his role and retire at the end of the AGM on the 15th of April.

21 Jan: Goldman Sachs reiterates its sell rating on Hunting (HTG) and reduced the target price to 402p (from 420p).

08 Jan: UBS reiterates its buy rating on Hunting (HTG) and reduced the target price to 510p (from 590p).

18 Dec: JP Morgan Cazenove reiterates its neutral rating on Hunting (HTG) and reduced the target price to 460p (from 490p).

18 Dec: Berenberg reiterates its hold rating on Hunting (HTG) and reduced the target price to 450p (from 480p).

18 Dec: Barclays Capital reiterates its equal weight rating on Hunting (HTG) and reduced the target price to 490p (from 500p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires