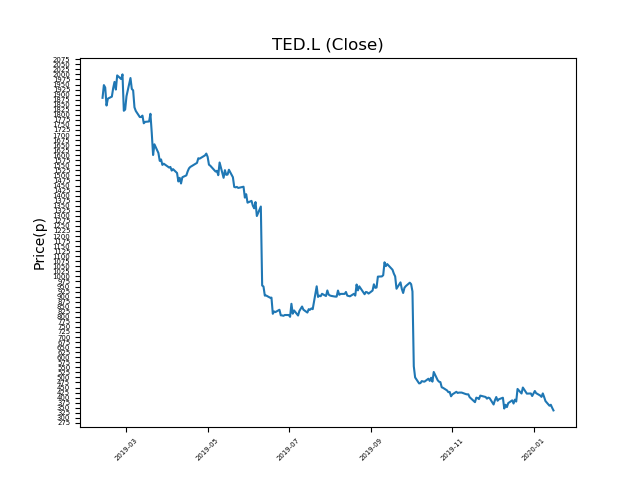

Ted Baker (TED.L) 16-01-20

Ted Baker (TED.L) shares have fallen significantly from the most recent highs of 2000p. Will it continue, or is this an opportunity to pick some up?

- A return to previous highs would represent a rise of 494%. Now at 336.6p (at time of writing).

- This is one of the biggest fallers of late.

- Traders should consider whether it is down for good reason, or is this another over-reaction?

- Bargain hunters should be mindful of fundamentals and events, which can influence price action. Check our website and news outlets for updates.

- Shares -83% from 12-month highs; +0% from 12 month lows.

Latest News

13 Jan: RBC Capital Markets has downgraded its rating on Ted Baker Plc (TED) to underperform (from sector performer) and reduced the target price to 300p (from 440p).

17 Dec: Ted Baker, the fashion company, announced that Ron Stewart was to leave his role as non-Executive Director. Stewart had held the role for the past for nine years.

16 Dec: HSBC reiterates its hold rating on Ted Baker Plc (TED) and reduced the target price to 345p (from 465p).

13 Dec: Goldman Sachs reiterates its neutral rating on Ted Baker Plc (TED) and reduced the target price to 390p (from 450p).

10 Dec: Peel Hunt reiterates its hold rating on Ted Baker Plc (TED) and reduced the target price to 300p (from 500p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires