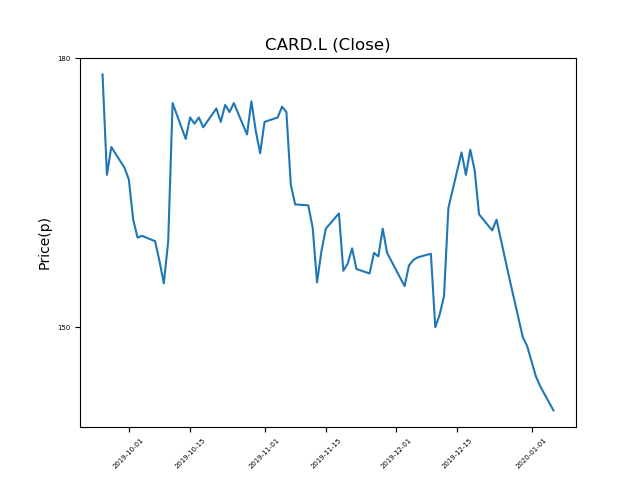

Card Factory (CARD.L) 06-01-20

Shares in Card Factory (CARD.L) have fallen dramatically from recent highs of 178.2p. Will it continue, or is this an opportunity to pick up a bargain?

- Now trading at 142.2p (at time of writing). A return to previous highs would represent a rise of 25%.

- This stock is one of the most significant fallers in the period.

- Is the trend your friend, or is a bounce imminent?

- The market often over-reacts to bad news. Traders should consider whether it is down for good reason, or is this another over-reaction?

- Bargain hunters should be mindful of fundamentals and events, which can influence price action. Check our website and news outlets for updates.

- Shares -32% from 12-month highs; +1% from 12 month lows.

Latest News

14 Nov: Card Factory announced that like-for-like sales declined moderately in Q3, as new shops and growth in digital stabilised the numbers in a slowing retail environment.

24 Sep: Card Factory announced that pre-tax profits had fallen to £24.3m from £28.4m, despite a like-for-like sales increase of 1.5%. The same period last year saw a like-for-like decline of 0.2%.

14 Aug: UBS reiterates its buy rating on Card Factory Plc (CARD) and reduced the target price to 220p (from 230p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires