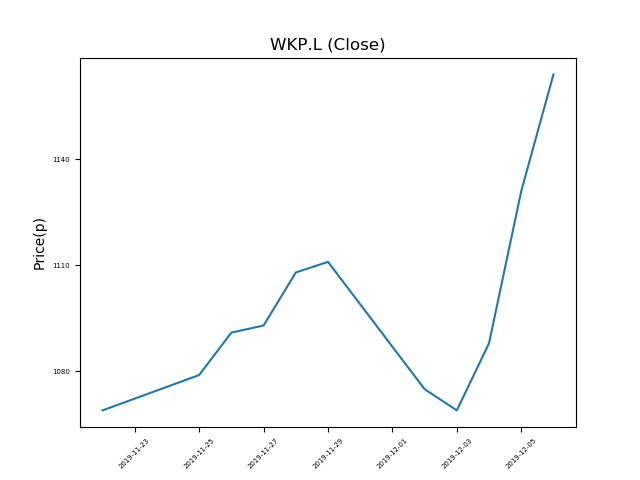

Workspace (WKP.L) 09-12-19

Workspace (WKP.L) has been in a strong uptrend. Will it continue to set new recent highs?

- Priced at 1157p (at time of writing), momentum has been strong.

- Will it come to an end, or is the trend your friend?

- Could this be an opportunity for momentum traders?

- Technical traders should be mindful of new developments, which can have an affect on trends.

- Shares -0% from 12-month highs; +46% from 12 month lows.

Latest News

02 Dec: JP Morgan Cazenove reiterates its overweight rating on Workspace Group Plc (WKP) and increased the target price to 1160p (from 1025p).

27 Nov: Workspace, the office space provider, announced it had reached an agreement to sell Quality Court in London for £15.8m.

19 Nov: RBC Capital Markets reiterates its sector performer rating on Workspace Group Plc (WKP) and increased the target price to 1200p (from 1050p).

15 Nov: Berenberg has downgraded its rating on Workspace Group Plc (WKP) to sell (from hold) and increased the target price to 950p (from 925p).

13 Nov: Workspace posted a 3% decline in H1 profit, after making no money from asset disposals. Income from rentals provided a boost, however, and the dividend was raised by 10%.

04 Nov: Barclays Capital reiterates its overweight rating on Workspace Group Plc (WKP) and increased the target price to 1000p (from 980p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires