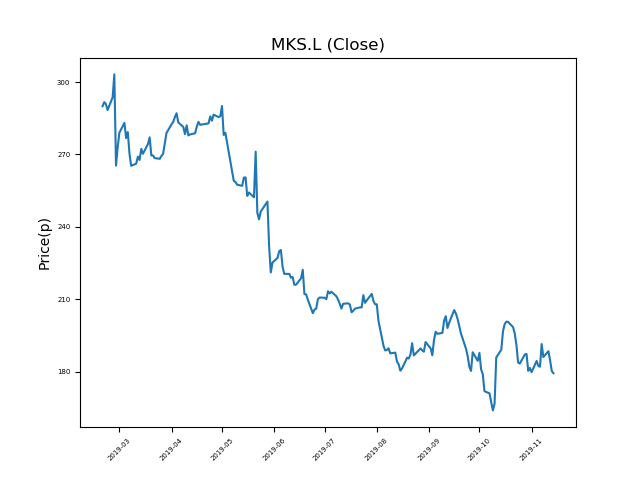

Marks and Spencer (MKS.L) 14-11-19

Shares in Marks and Spencer (MKS.L) have fallen dramatically from recent highs of 303.2p. Will it continue, or is this an opportunity to pick up a bargain?

- Now trading at 177.7p (at time of writing). A return to previous highs would represent a rise of 70%.

- The market often over-reacts to bad news. Traders should consider whether it is down for good reason, or is this another over-reaction?

- Shares -42% from 12-month highs; +8% from 12 month lows.

Latest News

11 Nov: RBC Capital Markets reiterates its sector performer rating on Marks & Spencer Group (MKS) and increased the target price to 200p (from 190p).

06 Nov: Marks & Spencer posted a 17% decline in H1 profit. Sales fell again in its clothing and home division.

16 Oct: Marks & Spencer confirmed that CFO Humphrey Singer would leave his role on 31 December.

02 Oct: Peel Hunt has downgraded its rating on Marks & Spencer Group (MKS) to hold (from buy) and reduced the target price to 200p (from 300p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires