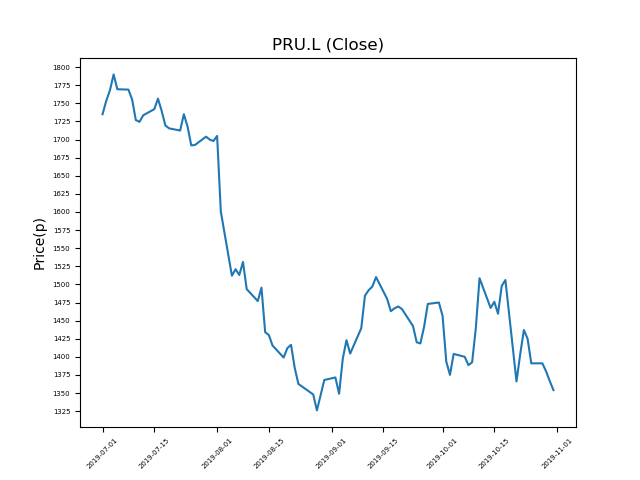

Prudential (PRU.L) 31-10-19

Prudential (PRU.L) has dropped from highs of 1790p. Will it continue, or could you pick up a bargain?

- Now trading at 1348.76p (at time of writing). A return to period highs would mean a rise of 32%.

- These shares are amongst the most significant fallers in the period.

- Markets constantly over-react to adverse news. Traders should consider whether the fall is reasonable, or is this another over-reaction?

- Bargain hunters should be mindful of the underlying fundamentals.

- Shares -24% from 12-month highs; +1% from 12 month lows.

Latest News

10:30: Societe Generale reiterates its sell rating on Prudential (PRU) and reduced the target price to 1200p (from 1300p).

29 Oct: Evercore reiterates its outperform rating on Prudential (PRU) and reduced the target price to 1600p (from 1850p).

29 Oct: Goldman Sachs today initiates coverage of Prudential (PRU) with a buy rating and target price of 1560p.

24 Oct: RBC Capital Markets reiterates its sector performer rating on Prudential (PRU) and reduced the target price to 1490p (from 1750p).

23 Oct: HSBC reiterates its buy rating on Prudential (PRU) and reduced the target price to 1835p (from 2250p).

23 Oct: Barclays Capital reiterates its overweight rating on Prudential (PRU) and reduced the target price to 1696p (from 2088p).

23 Oct: JP Morgan Cazenove reiterates its neutral rating on Prudential (PRU) and reduced the target price to 1329p (from 1606p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires