Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

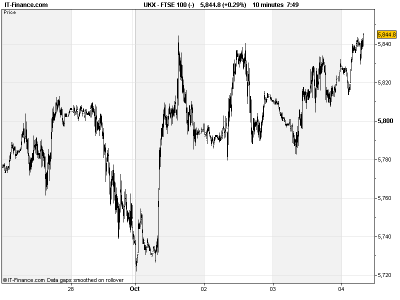

UK 100 called to open +20pts, after a positive yet uneventful session in Asia, with China still closed for its week-long Golden week holiday and the only macro data being disappointing – Aussie Building Approvals and Retail Sales. The Aussie dollar (AUD) has thus received another kicking, with expectations that another interest can’t be far off.

Caution remains the buzzword, despite positive sentiment attributed to yesterday’s ADP employment beat, especially ahead of tomorrow’s Non-Farm Payrolls (NFP), with the Eurozone continue to nag (Rajoy’s reluctance to ask for help; flagging growth; Germany to-ing and fro-ing) and many also awaiting updates from the big three central banks (policy updates, minutes, press conference).

US markets closed higher as the next update on US employment/unemployment edges closer, and the data all the more important with the US Federal Reserve (Fed) having explicitly tied unemployment to its quantitative easing (so long as no improvement, we’ll keep printing money to buy assets and bring down borrowing costs to help economy).

Note, however, that Correlation between ADP and NFP was absent last month with August ADP strong, but NFP coming in much lower, and below expectations. Note also that yesterday’s ADP included downward revisions to July and August. Other US macro data was mixed with ISM Non-Manufacturing beating expectations but the all-important employment index declining.

Other events of note are the apparent strong performance by Presidential Candidate Romney in his first debate encounter with incumbent Obama ahead of the US November elections.

All eyes on the central banks today with no changes by the Bank of England (BoE) or the European Central Bank (ECB). The Fed makes it a trio in the evening, with the publication of the minutes from the latest meeting – the one where QE3 was announced. That aside, macro data to watch is the US Jobless (solid last week) and Factory orders (economic barometer), as well as the Spanish debt sale (2-5yr, so shouldn’t pose a problem given market reaction to ECB backstop).

Oil is off its lows after further steep declines fuelled by concerns about the global economic slowdown, especially in China, but also in Europe following the ugly raft of PMI Services which dovetailed off the poor PMI Manufacturing on Monday. Continued unrest in the Middle East (heightened overnight with Turkey and Syria) remains a concern, giving a bit of support overnight, but with falling global demand this is insufficient to bolster prices.

In FX and Commodities, the USD is weaker overnight versus GBP and EUR overnight, with an accompanying rise in the price of Gold and Silver, and helped Oil (a bit) off its geopolitically fuelled lows near the US equity market close. GBP remains in weakening October trend versus EUR.

For any assistance with placing trades or if you require any supplementary information, call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Aussie Building Approvals Better MoM, but worse YoY

- Aussie Retail Sales Growth, but less than expected

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Robert Walters Q3 net fees up 1 pct, Asia Pacific slows

- Carillion says Q3 in line, reiterates FY guidance

- Renold issues profit warning on weak demand

- Ultra Electronics wins 14 mln stg UK MoD contract

- Halfords posts stronger second-quarter performance

- Promethean World Q3 sales down 41.2 pct yr-on-yr

- Ted Baker says remains cautious

- Providence awarded Dublin foreshore licence

- Gulf Keystone in $200 mln convertible bond offering

- Atlantic Coal says Stockton mine production rises

- Randall & Quilter buys RAB Insurance

- Petroceltic gets regulatory nod for Melrose merger