Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

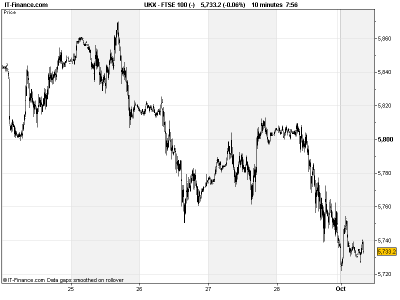

UK 100 called to open -5pts, remaining below the key 5750 level which was tested just ahead of and following the publication of the Spanish Bank stress tests on Friday. While the necessary figure for recapitalisation (€59.3bn) of Spain’s banks was in-line with the figure touted (€60bn), markets uncertain that the result or indeed assumptions (similar to last Thursday’s budget) are that credible.

While the stress test report was welcomed by the Troika (EU, ECB, IMF), saying the necessary funds would be prepared over the coming months, Spanish economy secretary sought to make life even more difficult for his country by saying that with existing efforts the final amount may be less (€40bn). Are we any closer to PM Rajoy making a full bailout request? Unlikely. Maybe they should have gone with something more like €80bn – halfway house between the €60bn expected and the €100bn pledged.

Hurdles still ahead though with Germany and certain ‘friends’ against allowing Spain’s banks to be rescued separately to the sovereign (different to June’s summit). There also remains the upcoming ratings review by Moody’s. While it says the stress test result was credit positive, it is not sure if it is enough to hold off a Spanish downgrade.

Weekend and overnight macro data disappointed on an absolute basis, with reported figures failing to inspire. Most notable was the official PMI Manufacturing which unexpectedly contracted suggesting potential for a weak Q3 at a time when slowing growth adds to existing global growth worries. The HSBC figure remained sub-50, but did improve a touch. Elsewhere in the region, Japanese macro data mixed with Tankan’s Q3 report still showing weakness in the economy.

Weak data giving some buoyancy to futures likely from expectations that the governments may be prompted to intervene to support the economy with more stimulus (note Chinese markets closed for much of this week – Golden Week).

The UK 100 has thus broken that key rising support level at 5,750 thanks to increased uncertainty regarding Spain after a surprisingly low recapitalisation figure for its banks. As we said in Friday’s Weekly roundup, the break of this support could open up downside to early September pre-ECB/Fed announcement lows of 5650. Upside now likely capped at 5800, via falling resistance from last Wednesday.

The macro calendar today will focus on PMI manufacturing data from Europe where expectations are for continued contraction across the board. Thereafter watch Eurozone unemployment and US ISM/PMI. Over the rest of the week, it’ll be back to central bank watching with ECB rate decision (no rate cut just yet), Bank of England rate decision and QE (rates unchanged, no more QE just yet) and the Bank of Japan (BoJ) on Thursday after its recent move.

In commodities and FX, Gold back off recent highs (although still in range near 1-month highs) after USD strengthened against the GBP and EUR. With Oil, the US Light Crude and Brent still in uptrend from month lows 10-days ago, but off last week’s highs thanks to USD move up against peers and continued geopolitical drivers.

Should you require any other help or information, make sure you speak to our trading floor.

Overnight/Weekend Macro Data: (Source: Reuters/DJ Newswires)

- China HSBC Manufacturing PMI Improved, but <50

- China Leading Index Improved

- UK Lloyds Business Barometer Unchanged

- UK Hometrack Housing Unchanged

- Japan Manufacturing Mixed

- China manufacturing PMI Worse

- Japan Vehicle Sales Deteriorated

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Cluff Gold changes its name to Amara Mining

- ITE sees year revenue of 170 mln stg, says confident

- Impax Asset Management says year earnings to meet forecasts

- ASOS names Amazon’s Brian McBride as chairman

- Victoria expects H1 breakeven

- Vectura partner Novartis gets COPD treatment nod

- British Land sells Cambridge retail centre

- Renew Holdings sees year profit in line

- Hammerson sells City property for 200 mln stg

- Charles Stanley sees first-half revenue flat

- Alstom wins €410m UK power station contract

- Entertainment One says trading in line

- Xstrata board backs Glencore’s $33 billion bid with conditions

- St Modwen confident on meeting expectations for year

- Sinclair IS Pharma signs dermatology distribution deal

- Exillon Energy confirms net oil play in update