Why get involved now?

The UK Index is off its worst levels, but its future is still uncertain. Many investors still ask themselves if the correction would continue, or if London’s blue-chips would rally back to summer highs. Why is now the best time to get involved in the markets?

In the words of the legendary business leader Warren Buffett, a wise investor should be “fearful when others are greedy and greedy when others are fearful.”

The logic behind Buffett’s statement is simple and straight-forward. The price of shares is determined by current supply and demand (i.e. traders buying and selling). But the intrinsic value of shares comes from discounting all future cash flows to the present, on the assumption that investors buy the right to receive regular revenue from the company in the form of dividends, capital returns, etc.

When most investors are “greedy” (read: bullish, buying shares en masse), prices typically rise, bringing them closer to intrinsic value, or even above it. Shares become overpriced and an investor’s potential return on equity decreases. However, when investors are “fearful” (i.e. selling shares), the opposite happens. The share price eventually falls below the stock’s intrinsic value.

When everyone else is selling and shares fall, Buffett advises the smart investor to be greedy and buy equities, receiving the full intrinsic value of shares (i.e. dividend payments), at a fraction of the implied equilibrium price. And when the market sentiment eventually recovers, with shares bouncing back, shareholders can benefit the second time from the speculation. Or, in the simplest terms, “Buy low and Sell high”.

Playing the contrarian

Keep in mind that prolonged market rallies and sell-offs only enhance Buffett’s maxim. When markets are in a rapid uptrend or downtrend, investor sentiment (fear and greed) becomes more pronounced, due to the concern over missing out or worries about already incurred financial losses. As the markets are falling, these fears grow, prompting panic selling and pushing shares into ‘undervalued’ territory even faster than normal.

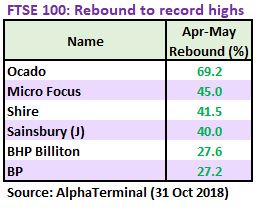

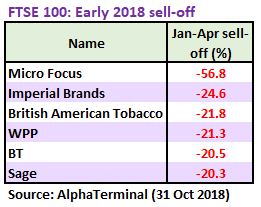

The sell-off begins with the most vulnerable stocks, companies experiencing commercial difficulties or operating in challenging market conditions, but at the peak of the ‘Bear Run’, even the most fundamentally sound companies become cheap. This is where an astute investor steps in and takes action to buy bargain-priced shares when everyone else is caught up in the negative sentiment.

Or, in the words of the 19th century banker Baron Nathaniel Rothschild: “The time to buy is when there’s blood in the streets, even if that blood is your own.”

Don’t call the UK Index ’s bottom

Does Buffett’s principle of “contrarian” investing mean that investors should buy their favourite stock every time when the market has sold-off, or should they be pickier about trading during a downtrend?

It is important to keep in mind is that calling a market bottom can be tricky even for the most experienced market watchers. The ongoing uncertainty over Brexit, the weakened state of the European economy and the US-China trade wars means that predicting the future of the UK Index is a futile and counterproductive effort. Similar economic and geopolitical uncertainties are typically present during most market sell-offs and crashes.

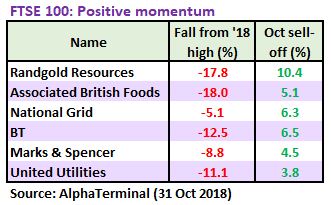

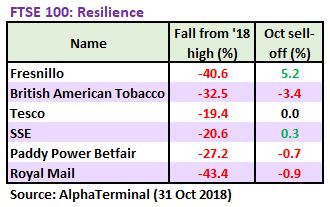

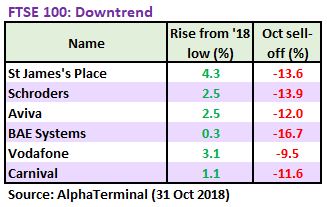

Rather than looking at the UK 100 index as a whole and trying to guess the point of reversal, where UK Index will turn and resume bullish movement, a careful investor should instead examine individual UK Index components. These blue-chip stocks can often represent a solid investment and move in the opposite direction from the downbeat stock market.

The reason why individual stocks can buck the overall negative trend can be diverse. Some companies can outperform the UK Index because of their exposure to international markets where trading conditions are more favourable.

Others benefit from paying large dividends, attracting long-term investors who are looking for a reliable cash flow during the downtrend. For example, steelmaker Evraz is forecast to pay a 12.44% dividend yield, the highest on UK 100 ; Evraz shares +58% year-to-date. (Source: Alpha Terminal, 1 November 2018)

Some companies have a fundamentally non-cyclical business models, for example, energy & water utilities or fast-moving consumer goods, insulating them when the general market turns bearish.

Picking the winners

The key to successful trading during a downtrend is to set strict criteria for picking interesting tradable opportunities. Because a sharp market sell-off can an unusual event to many retail investors, it is important to get out of the trading comfort zone and widen your trading horizons to the remainder of UK 100 list of blue chips, or, for the more daring, even to mid-caps.

Instead of focusing on just the usual suspects, which could be trading in-line with the overall bearish market (or even underperforming it), a better approach would to devise a set of trading criteria for picking stocks and look for blue chip stocks that satisfy these criteria.

It is equally important to maintain trading discipline. A market sell-off can see dramatic share price swings, but if you stick to your trading rules, respect key support & resistance levels and don’t prematurely call the market low, even the most volatile of bear markets can present exciting opportunities to buy and sell shares.

Turn the page to see some examples of technical criteria for picking stocks during market downturn, which we can group under several distinct categories.