Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

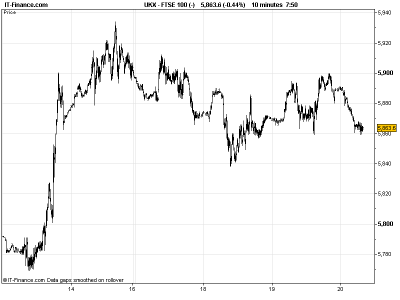

UK 100 called to open -30pts, with risk appetite taking a meaningful dip in Asian markets as yesterday’s Bank of Japan (BoJ) announcement that it was adding to the global quantitative (QE) party failed to have the same market-boosting effect as peers’ recent action. All QE is equal, but some is more equal than others, eh? Nonetheless, after recent strong gains by world equities (bar China), an element of profit taking is understandable within the longer term uptrend.

The key piece of overnight data came for China, with the China HSBC Flash Manufacturing PMI. The index limped up in September, but remains below that key 50 growth contraction level. A stabilising may be a welcome sign from the slowing nation, but in the absence of significant stimulus and a revival of growth, concerns prevail. Alongside this, Japanese exports and imports were down by over 5% in August and industry activity weakened, providing a troubled macro message from the region.

With Europe and US markets having closed with of modest gains, helped by US Existing Home Sales and signs of progress in Greece on budget cut negotiations, the news from Asia has seen the UK 100 test its trend of rising lows from 5 September, which could open up potential for a larger correction given that so many central banks have already pulled the trigger. Then again, China could always turn up….

Today, watch out for Spain selling up to €4.5b in 3yr and 10yr debt. Will borrowing costs improve enough to make funding sustainable? Will they remain low enough to keep PM Rajoy from asking for aid, keeping investors on tenterhooks? While yields will be key, so will demand, as a gauge of confidence in the nation following the ECB’s pledge and bond market intervention plan.

PMI Manufacturing and Services data from Germany and the Eurozone. These are all seen remaining below the important 50 growth/contraction level, dented by austerity and recession, although they are seen improving from last month’s readings. In the UK, Retail Sales data for August are expected to show negative growth, with year-on-year growth pretty much unchanged. CBI Trends also seen improving. In the US, jobless data, now key given that US Federal Reserve (Fed) Chairman Bernanke has tied its improvement to his quantitative easing (QE) programme, is likely to have been relatively flat on last week. Consensus points to Eurozone consumer confidence improving slightly, while US Leading Indicators may post a rebound.

In the Commodities space, Gold has weakened back to the $1760 level, following the USD’s strengthening versus peers post QE, however, the metal has yet to make a correction of the same magnitude as the currencies and remains in a solid 1-month uptrend. Note, however, that significant resistance lies just above recent highs. The large build in US Crude Oil inventories yesterday was a surprise piece of data, which combined with the middle-east boosting production, has seen both US Light Crude and Brent maintain their sharp down moves since the end of last week.

In the FX arena, GBP/USD has topped out, falling back below 1.62, as the greenback recovers from some of its QE3-induced weakening and the Bank of England (BoE) minutes from its latest Monetary Policy Committee (MPC) meeting showed officials seeing a chance of more stimulus (growth weak, higher inflation) which dented sterling’s recent strength. EUR/USD has fallen back below the 1.30 handle, a level last seen just after the QE3 announcement. Could both pairs maintain their corrections?

For any other help you may need, be it market information or assistance with trading, make sure you speak to our trading floor.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Japan Merchnds Trade Balance Better

- China HSBC Flash PI Manuf Improved

- Japan All industry Activity Index Worse

- Germany Producer prices Better

- Switz Trade balance Declined

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Xcite Energy: Bentley Field Well Test Results Exceeded Expectations

- Ricardo profit grows 14 pct

- Booker Group 2nd qtr sales rise

- M&C Saatchi H1 profit before tax 8.7 mln stg; up 13 pct

- UK regulator finds BSkyB ‘fit and proper’ broadcaster

- Imperial Tobacco sales boosted by price rises

- Capital Shopping Centres launches 300 mln stg bonds

- Ocado says sales rise 9.9 pct in 12 week period

- United Utilities says confident on long-term targets

- Moss Bros H1 sales grow 5.7 pct, sees FY in line

- Gulfsands Petroleum Narrows First Half Loss Despite Lower Revenue