AB Foods

A range trading opportunity for you?

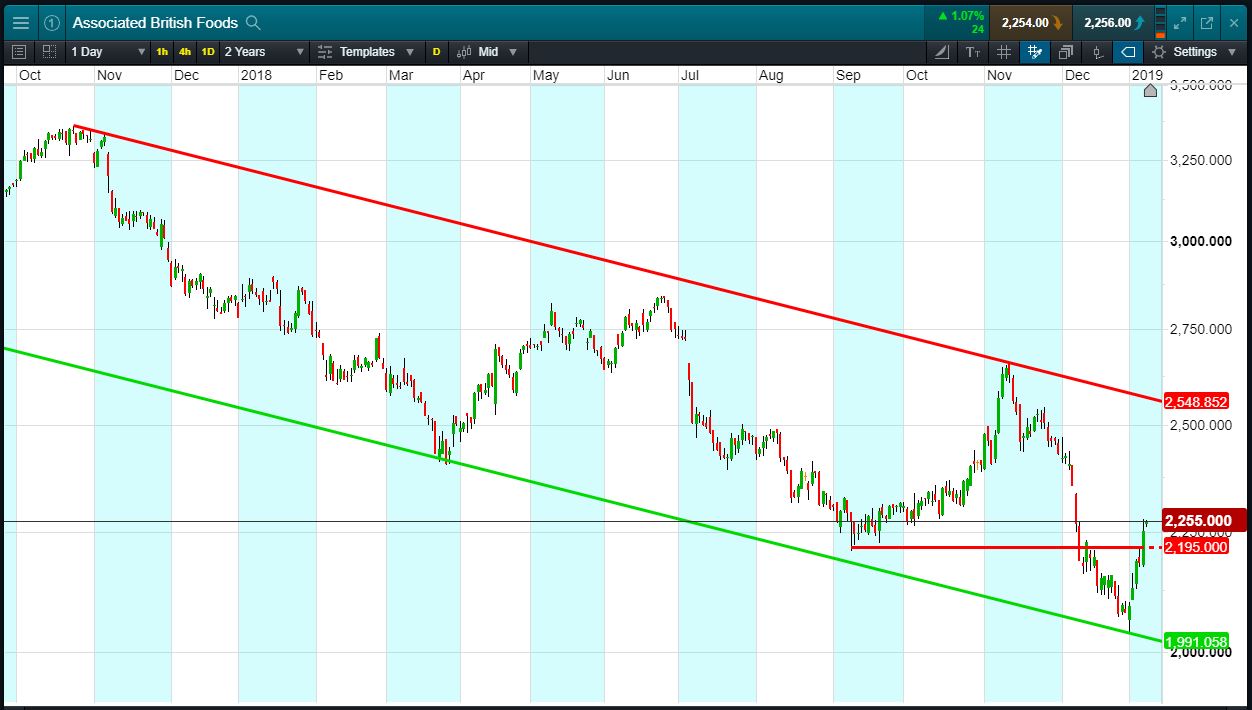

Will AB Foods break lower, or will it rise back again to 2500p?

- AB Foods is in a falling channel range since October 2017.

- Bounced off rising support trendline 3 times, and broken back above 2195p

- Now trading 2255p (at time of writing)

- Will the pattern repeat itself, testing previous highs?

- Shares -23.2% from 2018 highs; +10.9% from 2018 lows; +10.3% year-to-date

- 9 Jan: Ted Baker reports strong Christmas sales

- 3 Jan: RBC says Next Christmas sales cheer bodes well for rivals

- issues a trading updates on 17 Jan

- Source: Bloomberg, FT, Reuters, DJ Newswires, AlphaTerminal

Trading AB Foods – An Example

Let’s say you like the range, you think it’s heading back towards 2500p again. You decide to buy exposure to £10,000 worth of AB Foods using a CFD, at the current price of 2255p. To do this, you need £2,000.

Let’s assume AB Foods rises back to 2500p (+10.8%). Your profit would be £1080, from your initial investment of £2,000.

Conversely, let’s assume you open the above position, and place a stop-loss at 3% from the current price. AB Foods falls 3% and hits your stop-loss. Your loss would be £300.

This is provided for information purposes only. It should not be taken as a recommendation.