Aggreko

A range trading opportunity for you?

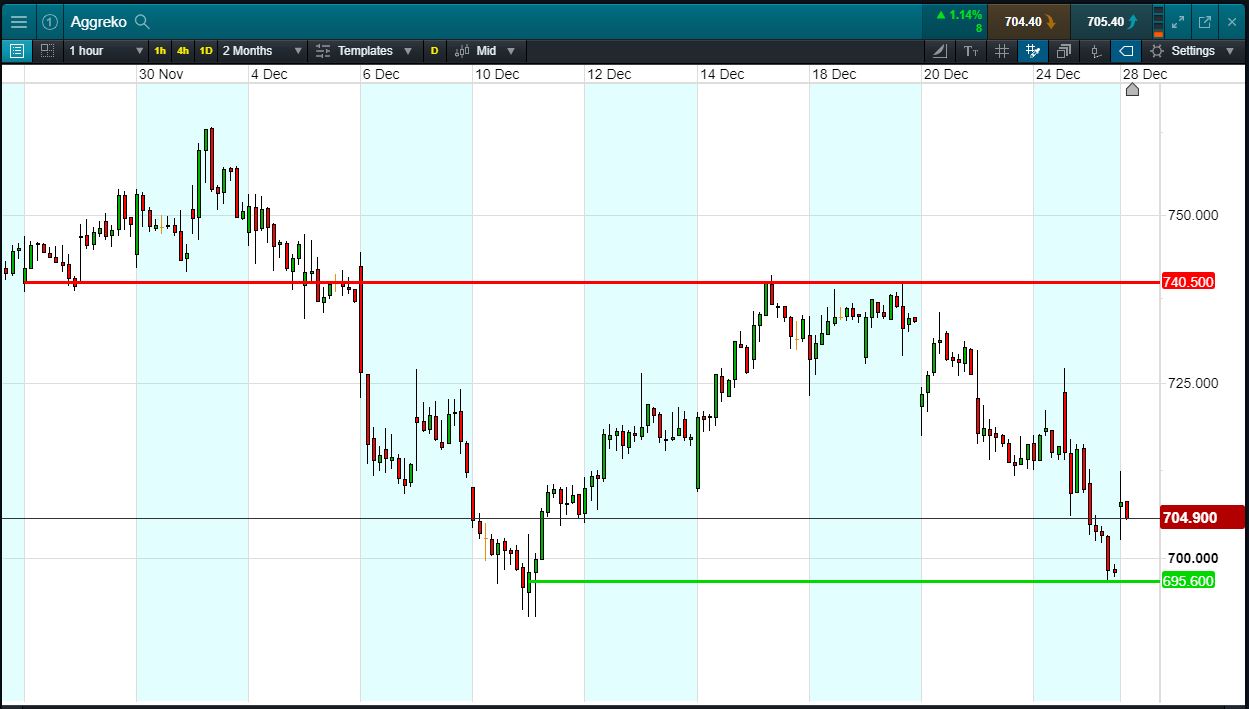

Will Aggreko break lower, or will it rise back again to 740p?

- The Aggreko range has developed in December (June resistance turned December support)

- Bounced off 695p support zone twice. Now trading 705p (at time of writing)

- Will the pattern repeat itself, testing previous highs?

- Shares -21.9% from 2018 highs; +9.2% from 2018 lows; -11.7% year-to-date

- Supplier of temporary power generation and temperature control equipment

- 14 Dec: Aggreko wins $200m Tokyo Olympic supply contract

- Source: Bloomberg, FT, Reuters, DJ Newswires, AlphaTerminal

Trading Aggreko – An Example

Let’s say you like the Aggreko range, you think it’s heading back towards 740p again. You decide to buy exposure to £10,000 worth of Aggreko using a CFD, at the current price of 705p. To do this, you need £2,000.

Let’s assume Aggreko rises back to 740p (+5.0%). Your profit would be £500, from your initial investment of £2,000.

Conversely, let’s assume you open the above position, and place a stop-loss at 3% from the current price. Aggreko falls 3% and hits your stop-loss. Your loss would be £300.

This is provided for information purposes only. It should not be taken as a recommendation.