Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires

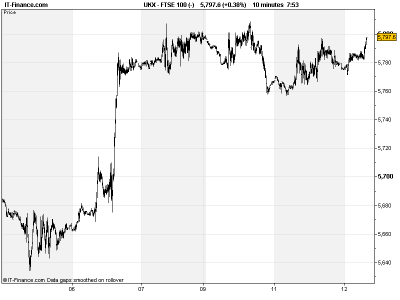

UK 100 called to open +5pts, with Asian markets indicating continued risk appetite (four days of rises) ahead of the US Federal Reserve (Fed) policy meeting and potential announcement on stimulus as well as this morning’s key German Constitutional Court ruling on the Eurozone’s successor bailout fund the ESM (European Stability Mechanism), which is key to European Central Bank (ECB) President Draghi’s plans to help troubled sovereigns’ borrowing costs.

While hopes high that US Fed will deliver on the stimulus front, sentiment also helped by Chinese Premier Wen hinting at new measures while talking at the World Economic Forum in light of recent slowing growth data. Both aspects helped resources stocks in Asia. Speculation (conflicting) that Spanish PM Rajoy may be considering asking for help also boosted optimism, with a request being necessary before any ECB bond market intervention.

In the US, markets closed mixed (tech down, broader markets higher) after positive macro data (Small Business Optimism, Trade Deficit, Economic Optimism). Having had rating agency Moody’s warn on the US debt rating, peer Eagan Jones followed suit citing any additional Fed stimulus as a negative. On a down note, Texas Instruments warned on chip demand and narrowed Q3 guidance to beating the lower end of guidance.

Overnight, macro data largely positive with Japanese Machine Orders rebounding along with Aussie Consumer Confidence. This morning, inflation figures from France and Germany are a little hotter than expected, but nothing worrying, however, if we continue to see rises, ECB rate cutting possibilities would likely be dented.

In Commodities Gold has rebounded back near to Friday’s high of $1740 as expectations of Fed stimulus burns strong. Oil has also taken a tick up on hopes that stimulus measures stoke industrial demand. Note the closes to 1-week highs which could be resistance.

In FX, USD has continued to weaken above 1.60 vs GBP on stimulus expectations (1-week trend of rising lows). Note that May highs were 1.63. USD also near 1.29 vs EUR on combination of stimulus expectations and European Central Bank commitment to sovereign borrowing costs, as well as possibility that Spain makes official request for help.

In today’s macro line-up, the main event will be Germany’s Constitutional Court decision on the ESM. Investors reassured yesterday on news decision would be given today and not delayed. Most expecting the fund will passed as acceptable in German law. Watch out also for UK unemployment (seen flat), Eurozone Industrial Production (seen flat in July, but down on the year). US data seen showing Wholesales inventories up slightly in August, but less than in July.

For any other information, don’t hesitate to put a call in to your friendly trader.

Overnight/Weekend Macro Data: (Source: Reuters/DJ Newswires)

- Japan Machine Orders Better

- Aussie Consumer Confidence Improved

- India Industrial Production Worse

- France Consumer inflation Slightly stronger

- Germany Consumer inflation Slightly stronger

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Kingfisher H1 profit down 15.5 pct

- Barratt Developments year profit more than doubles

- Thorntons year profits falls, waives dividend

- Gulf Keystone Petroleum Half Yearly Report; plans to submit Kurdistan plan by end Jan.

- Cluff Gold signs funding deal with Samsung

- President Petroleum to raise $49 mln for Paraguay deals

- African Eagle Resources Ore Testwork at Dutwa Exceeds Expectations

- Frontier Mining Half Year Loss Widens

- Alliance Pharma First-Half Profit Drops, Looking for Acquisitions

- Shell Drilling in Arctic Delayed by Ice

- Afren: East Simrit Exploration Drilling Starts