UK Index Dividend Recovery

Did you take advantage of a dividend recovery play?

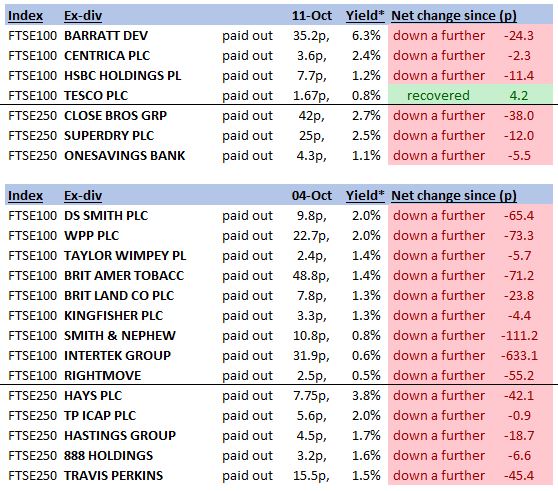

UK Index companies that paid dividends on Thurs 11 Oct: Barratt Developments, Centrica, HSBC, Tesco, Close Brothers, Superdry and OneSavings Bank.

UK Index companies that paid dividends on Thurs 4 Oct: AA, Balfour Beatty, Barr (A.G.), Bodycote, British American Tobacco, British Land, British Land, Daejan Holdings, DS Smith, Finsbury Growth & Income Trust, James Fisher, Foreign & Colonial Inv Trust, Hastings, Hays Hunting, Intertek, Intertek, Kingfisher, Murray International Trust

Rightmove, RIT Capital Partners, Scottish Investment Trust, SIG, Smith & Nephew, Smith (DS), Synthomer, Taylor Wimpey, TP ICAP, Travis Perkins, WPP

Source: Bloomberg; Last Updated: 11 Oct 2018

- Shares typically fall by the amount of the dividend being paid. Many shares then tend to recover over a period of time, helped by dividends being reinvested, creating a dividend recovery trade opportunity.

- Our table highlights whether the shares have fallen further following the dividend payment (net loss), or whether they have, in fact, begun to recover and close the gap (net profit).

- * Yields relate to that particular dividend as percentage of ex-div share price, not the annual yield.

Trading Barratt Developments – An Example

Let’s say you liked Barratt Developments and wanted to receive the 35.2p/6.3% dividend. You decided to buy exposure to £10,000 worth of Barratt Developments using a CFD. To do this, you needed £2,000.

Shares that go ex-dividend typically fall by the amount of the dividend on the ex-dividend date. Many shares then tend to recover over a period of time, helped by dividends being reinvested, creating a dividend recovery trade opportunity.

Assuming Barratt Developments shares recover to their pre-dividend payment share price, your profit from the dividend recovery would be £630, from your initial investment of £2,000.

Be aware that the share price can fall or rise, which could mean that you could make an overall loss or increase your profit on the position. For example, let’s assume that Barratt Developments fell 5% at the same time it paid the 6.3% dividend. Your overall net loss on your £10,000 position would be £500.

This is provided for information purposes only. It should not be taken as a recommendation.