This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

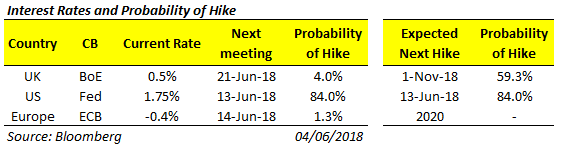

The strongest factors influencing the direction and momentum of Foreign Exchange (FX) rates are changes in the key interest rates, themselves highly sensitive to macroeconomic data such as inflation and economic growth. Higher interest rates tend to render the currency more attractive (and vice versa) which in turn can result in it strengthening versus other currencies.

In the UK, interest rate policy is determined by the Bank of England’s (BoE) Monetary Policy Committee (MPC), which meets several times a year and whose decisions are closely watched by all FX traders, especially those trading Pound Sterling (GBP).

In the US, key interest rate decision-making body is the Fed’s Federal Open Market Committee (FOMC), influencing the US Dollar (USD), while for the single currency Euro (EUR) in the Eurozone, it is the European Central Bank (ECB).

The following events this week could have a major impact on FX markets.

GBP

In a week with sparse UK economic data, Brexit negotiations will maintain their outsize influence on the Pound, with UK government indicating it intends to remain a part of EU VAT area after 2020 (Source: FT), which could partially bind it to EU regulations (and EU judiciary). With potential for a “no deal” outcome surfacing on the agenda, markets will be looking for clarification from PM May’s cabinet before committing to a direction.

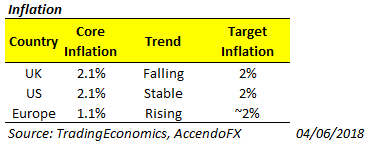

At the end of the week (Fri, 7 Jun), the Bank of England will release its May TNS Inflation Attitude Surveys for the next 12 months. With UK posting soft inflation so far into 2018, which has dampened expectations of an imminent interest rate hike, economists will be looking to parse future inflation sentiment to gain insight into the policymakers’ thinking.

EUR

Economic data from Germany and Euro Area will drive the direction of the European single currency this week. Eurozone Retail Sales (Tue, 10am) are expected to show a rebound after softer previous month. with German Factory Orders (Thu, 7am) and Exports/Imports (Fri, 7am) are also both seen to post improved figures. Euro Area Q1 GDP 3rd estimate (Thu, 10am) is expected to confirm quarterly slowdown seen in the first 2 estimates.

If positive Eurozone economic data is confirmed, it could help EUR finally break out of a falling channel against the Dollar.

USD

Geopolitics and global trade will provide momentum to the US Greenback this week, with trade wars (with China, EU, Canada, etc) on the agenda. Leaders of the G7 group of industrialised nations are meeting in Quebec for a summit on Friday, and the meeting is expected to pit President Trump against the rest of the world economic powers.

US side will, doubtless, attempt to clarify its intentions and reassure allies, but the countries affected vowed to retaliate with trade restrictions of their own. News of worsening Transatlantic relations could put further strain on the recently embattled USD.

In anticipation of the long-mulled Trump/Kim summit in mid-June, President Trump will be meeting with Japanese PM Shinzo Abe on Wednesday, to bring US and Japan on the same page with regards to plans to de-nuclearise North Korea.

With US-China trade negotiations ongoing and with no progress in sight, FX markets will be looking forward to US (Weds, 1:30pm) and China’s (Fri, 4am) import/export figures to gauge the size of the trade imbalance at stake in Sino-American talks.

In anticipation of next week’s Fed’s FOMC meeting (13 Jun), analysts have upped their expectation of an interest rate hike to 84% (Source: Bloomberg, Date: 04.06.18), which could provide advance support to the USD even ahead of the meeting.

(Sign up here to receive our daily live macro-calendar)

Tuesday 5 June

Major UK Economic Data

09:30 Services PMI

Major Intl Economic Data

02:45 Caixin Services PMI (China)

10:00 Retail Sales (Eurozone)

Wednesday 6 June

Major Intl Economic Data

08:30 Construction/Retail PMI (Germany)

13:30 Trade Balance (US)

Thursday 7 June

Major Intl Economic Data

07:00 Factory Orders (Germany)

10:00 Q1 GDP 3rd est. (Eurozone)

Friday 08 June

Major UK Economic Data

09:30 BoE/TNS Inflation Next 12 Months

Major Intl Economic Data

04:00 Trade Balance, Foreign Direct Investment (China)

00:50 GDP (Japan)

07:00 Trade Balance, Industrial Production (Germany)

Technicals

Technicals

Technicals

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research

Comments are closed.